X-trader NEWS

Open your markets potential

Coinbase's latest monthly outlook: liquidity returns in autumn, and the copycat season will explode in full swing

Author: David Duong, Coinbase

Translator: Tim, PANews

Article Overview

Coinbase remains optimistic about the prospects for the third quarter of 2025, though its view on the "altcoin season" has shifted. Based on current market conditions, it believes that as September approaches, the market may transition into a full-fledged altcoin season. (A common definition of an altcoin season is when at least 75% of the top 50 altcoins by market capitalization outperform Bitcoin over the past 90 days.)

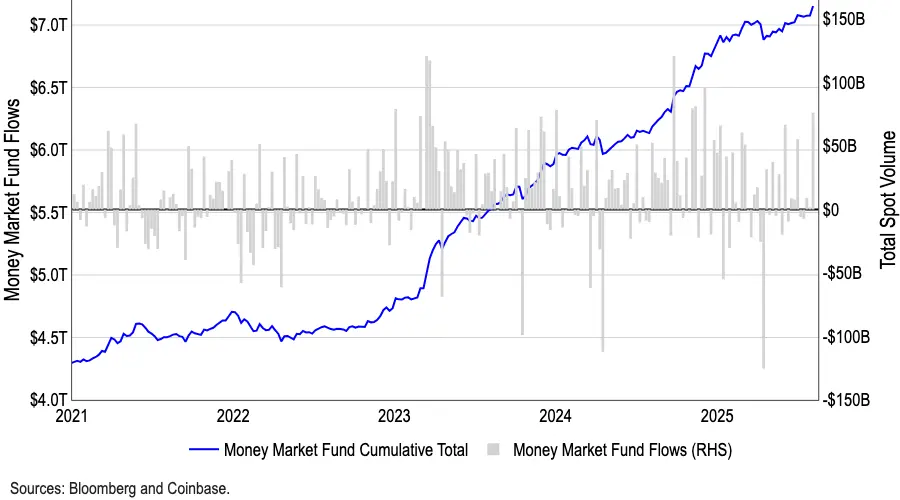

Many have debated whether a Federal Reserve rate cut in September would mark a cyclical peak for the crypto market. We disagree. Given that nearly $7 trillion in retail capital remains on the sidelines, including in money market funds and other areas, we believe the Fed's policy easing could attract more retail investors into the market over the medium term.

Focusing on ETH: The underperformance of CoinMarketCap's Altcoin Season Index, in stark contrast to the 50% surge in the total market capitalization of altcoins since early July, underscores the growing institutional enthusiasm for ETH. This rally is supported by rising demand for Digital Asset Treasuries (DAT) and the growing narrative around stablecoins combined with RWA.

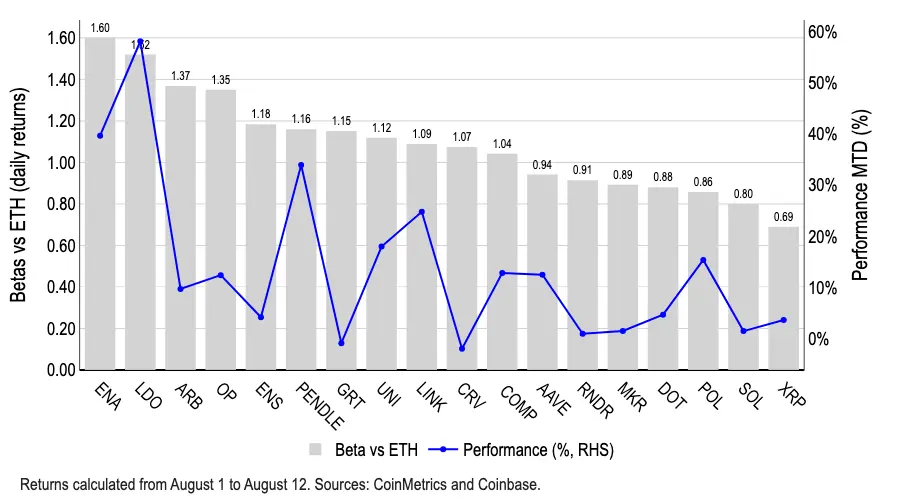

Tokens like ARB, ENA, LDO, and OP have consistently demonstrated higher beta returns than ETH, though only LDO has led with a 58% monthly gain. Historically, Lido has provided a relatively direct exposure to ETH through its liquid staking features. Additionally, we believe the SEC's statement that "liquid staking tokens do not constitute securities under certain conditions" has supported LDO's appreciation.

Entering Altcoin Season

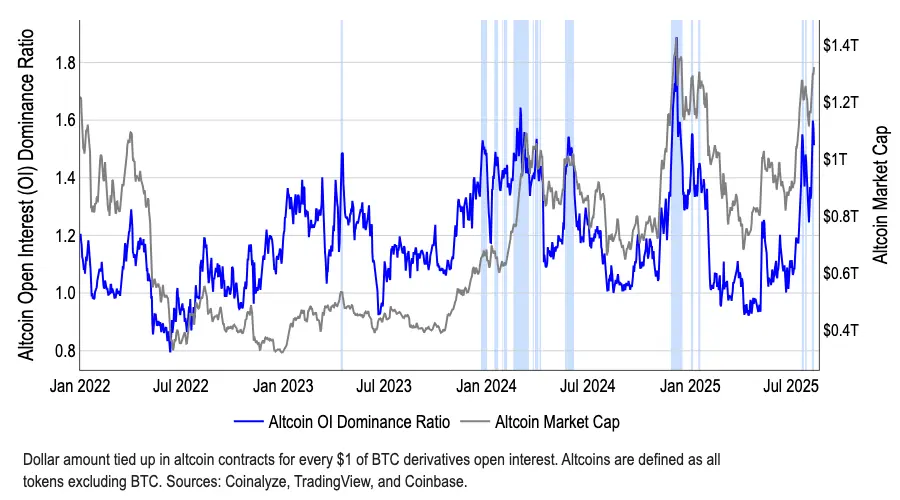

As of August 2025, Bitcoin's market dominance has fallen from 65% in May to approximately 59%, indicating that capital is beginning to shift toward altcoins. While the total market capitalization of altcoins has surged by over 50% since early July, reaching $1.4 trillion as of August 12, CoinMarketCap's Altcoin Season Index remains in the low 40s, well below the historical threshold of 75 that signals the start of an altcoin season. As we move into September, we believe current market conditions show signs that a full altcoin season is imminent.

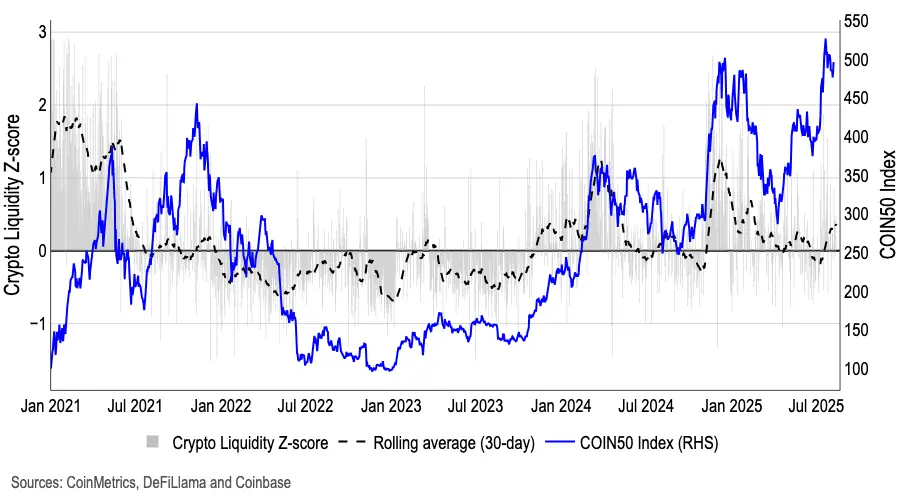

Our optimistic outlook stems from a holistic view of macroeconomic factors and expectations for significant regulatory progress. As we have previously noted, our proprietary Global M2 Money Supply Index, which typically leads Bitcoin prices by 110 days, suggests a potential new wave of liquidity could arrive from late Q3 to early Q4 2025. This judgment is particularly crucial because in the institutional capital space, investment themes seem to have centered on large-cap coins. In our view, the main driver of an altcoin season will come from retail investors.

The current size of U.S. money market funds, which has reached $7.2 trillion (the highest on record), is noteworthy. (See Figure 2) Cash reserves decreased by $150 billion in April, which we believe contributed to the strong performance of cryptocurrencies and risk assets in the subsequent months. Interestingly, however, cash reserves have rebounded by over $200 billion since June, in sharp contrast to the simultaneous rise in cryptocurrency prices. Traditionally, cryptocurrency price gains and cash reserve levels have tended to move in opposite directions.

We believe these unprecedented cash reserves reflect three key market concerns: (1) Increased uncertainty in traditional markets (stemming from issues such as trade conflicts); (2) Overvalued markets; (3) Persistent concerns about economic growth. However, as the Federal Reserve's rate cuts in September and October approach, we believe the appeal of money market funds will begin to diminish, and more capital is expected to flow into cryptocurrencies and other higher-risk asset classes.

A liquidity-weighted z-score model, built using indicators including net stablecoin issuance, spot and perpetual contract trading volumes, order book depth, and circulation, shows that liquidity has started to return in recent weeks, ending a six-month downward trend (see Figure 3). The growth of the stablecoin market is partly due to the increasing clarity of regulatory frameworks.

Ethereum Beta Targets

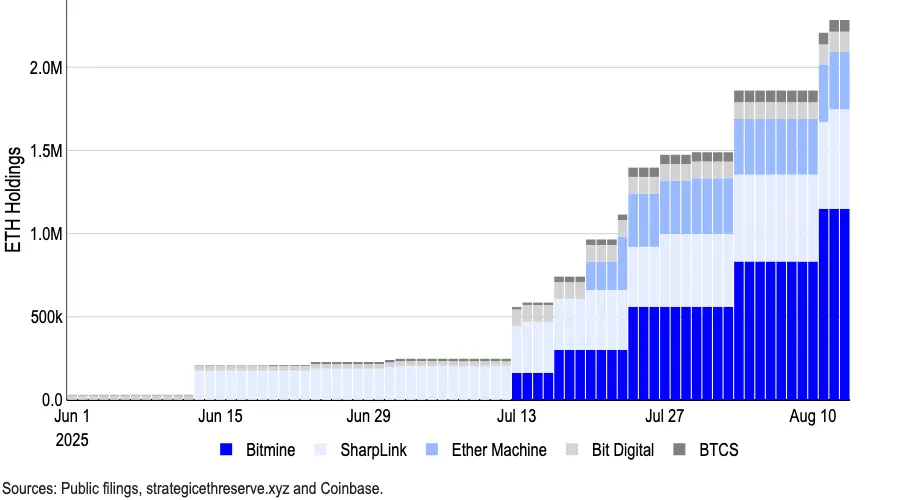

Meanwhile, the divergence between the Altcoin Season Index and the total market capitalization of altcoins mainly reflects Ethereum's growing institutional appeal, driven by demand for digital asset treasuries and the rise of stablecoin and RWA narratives. Bitmine alone has added 1.15 million ETH with its newly raised $20 billion, bringing its cumulative purchasing power to $24.5 billion (compared to Sharplink Gaming, which once led in ETH holdings and currently holds approximately 598,800 ETH).

Latest data shows that as of August 13, the largest corporate holders of ETH reserves control approximately 2.95 million ETH, accounting for over 2% of Ethereum's total supply (12.07 million ETH). (See Figure 4 for details)

Tokens such as ARB, ENA, LDO, and OP rank among those with higher beta relative to Ethereum's returns. However, in the recent Ethereum rally, only LDO has stood out, with a monthly gain of 58%. Historically, Lido has provided investors with relatively direct exposure to Ethereum through its liquid staking features. Currently, LDO has a beta coefficient of 1.5 relative to ETH (a beta greater than 1.0 means the asset is theoretically more volatile than the benchmark, which can amplify both gains and losses).

Furthermore, we believe the U.S. SEC's statement on liquid staking released on August 5 has supported the price increase of LDO tokens. Staff from the SEC's Division of Corporation Finance clarified that when a liquid staking entity's services are primarily "transaction-execution based" and staking rewards are passed directly to users on a proportional basis through the protocol, such activities do not constitute the offer or sale of a security. However, it should be noted that if收益 guarantees, discretionary re-staking, or additional reward mechanisms are involved, they may still trigger a securities classification. The current guidance is only a staff opinion, and future changes in the Commission's position or litigation rulings could alter this interpretation.

Conclusion

Our Q3 market outlook remains positive, but our assessment of the altcoin market has changed. The recent decline in Bitcoin's dominance indicates that capital is beginning to rotate into altcoins, though not yet in full force for an altcoin season. However, as the total market capitalization of altcoins climbs and the Altcoin Season Index shows early positive signals, we believe market conditions are preparing for a capital rotation, and a more mature altcoin season could arrive in September, supported by both the macroeconomic environment and expectations of regulatory progress.

Disclaimer: The views in this article only represent the author's personal opinions and do not constitute investment advice for this platform. This platform does not guarantee the accuracy, completeness, originality, or timeliness of the article's information, nor does it assume any responsibility for any losses arising from the use or reliance on the article's information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada