X-trader NEWS

Open your markets potential

Texas builds Bitcoin reserve, why is BlackRock BTC ETF the first choice?

# Texas Takes First Official Step to Become U.S.'s First State with Bitcoin as Strategic Reserve Asset

By Oluwapelumi Adejumo

Compiled by Saoirse, Foresight News

Texas has officially taken the first step toward potentially becoming the first U.S. state to classify Bitcoin as a strategic reserve asset.

On November 25, Lee Bratcher, Chairman of the Texas Blockchain Council, revealed that the state—an economy worth $2.7 trillion, ranking 8th globally—has purchased $5 million worth of BlackRock's spot Bitcoin ETF (ticker: IBIT).

He added that once the state finalizes the custody and liquidity framework required by the new reserve bill, a second $5 million allocation will be used to directly acquire Bitcoin.

These two tranches of funds will bridge the gap between the current institutional operational model and the future government model of "not only buying Bitcoin, but also holding it directly."

## Texas's Blueprint for the First State-Level Bitcoin Reserve

Texas initially opted for IBIT as an entry point rather than holding Bitcoin directly on-chain. For large capital allocators seeking to add Bitcoin to their portfolios within familiar regulatory and operational systems, IBIT has emerged as the default choice.

The legal basis for this purchase is Senate Bill 21, which was signed by Governor Greg Abbott in June this year and formally established the "Texas Strategic Bitcoin Reserve."

Under the bill's framework, the state comptroller is authorized to continuously increase holdings of Bitcoin as long as the cryptocurrency maintains an average market capitalization of no less than $500 billion over 24 months. Currently, Bitcoin is the only cryptocurrency meeting this market cap threshold.

The reserve system operates independently of the state treasury, with clear governance processes for asset holdings and an advisory committee responsible for risk monitoring and oversight.

While the initial $5 million investment is modest compared to Texas's overall fiscal scale, the operational logic behind the transaction is far more significant than the amount itself.

Through this move, Texas is testing whether Bitcoin can be formally integrated into public reserve instruments within a state-level financial system that already manages hundreds of billions of dollars across diverse funding pools.

Once the relevant operational processes are in place, the second tranche of funds will be used for "direct Bitcoin holdings"—a model that will have distinctly different implications for asset liquidity, transparency, and audit procedures.

Texas is currently designing a "sovereign-level custody" process instead of adopting traditional institutional brokerage models. The reserve system will require qualified custodians, cold storage facilities, key management protocols, independent audit mechanisms, and regular reporting requirements.

These elements will form a replicable template that other states can adopt directly without redesigning governance structures.

## Why BlackRock's IBIT Became Texas's Top Choice

Choosing IBIT to enter the Bitcoin market does not mean Texas prefers ETFs over native Bitcoin; it is essentially a pragmatic workaround based on operational realities.

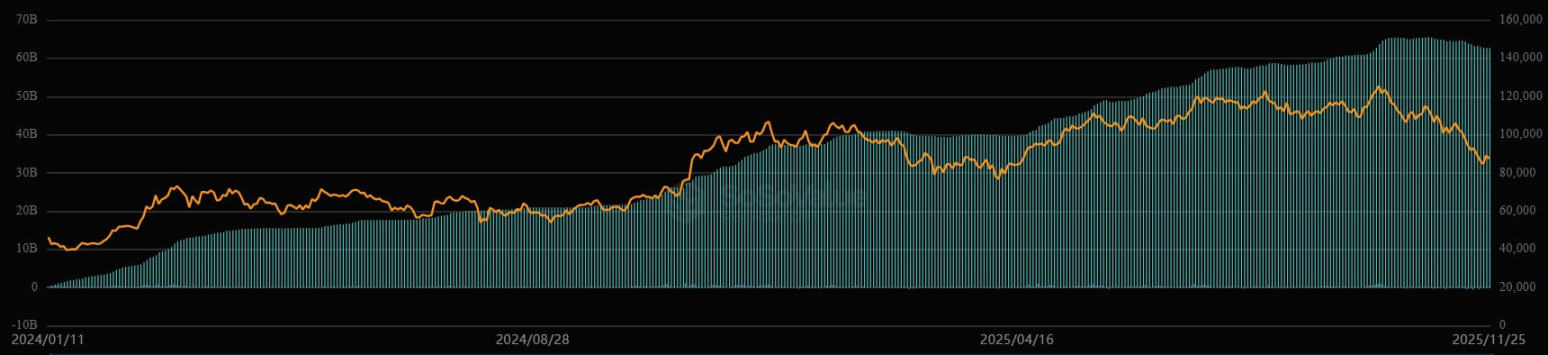

Launched just two years ago, IBIT has become the most widely held Bitcoin ETF among mainstream institutions. As the largest Bitcoin ETF by assets under management, it has accumulated over $62 billion in net inflows.

Furthermore, most regions have not yet established custodial systems for public-sector direct Bitcoin holdings, and building such infrastructure requires a series of complex processes including procurement, security modeling, and policy approval. Therefore, Texas is using IBIT as a "transitional tool"—to achieve Bitcoin allocation while refining the permanent reserve architecture.

This "indirect strategy" is highly illustrative, as it closely aligns with the allocation paths of other large capital holders.

Harvard University disclosed that IBIT became one of its top U.S. stock holdings in the third quarter; the Abu Dhabi Investment Authority tripled its IBIT position to approximately 8 million shares during the same period; and the Wisconsin State Pension System allocated over $160 million to spot Bitcoin ETFs earlier this year via IBIT.

The trend is clear: despite differences in investment objectives, geographic attributes, and risk frameworks, various institutions have unanimously chosen IBIT. Its core advantages lie in: custodial services provided by a reputable intermediary, simplified reporting processes, and compliance with clear accounting requirements under the new fair value rules effective in 2025.

These conveniences have made IBIT the "default entry point" for public and quasi-public institutions to allocate to Bitcoin. Texas's uniqueness lies only in that its IBIT allocation is a "temporary transition."

## Potential Impacts if Other States Follow Suit

A more critical question is: Is Texas's move an isolated case, or will it become a blueprint for other states to emulate?

Bitcoin analyst Shanaka Anslem Perera stated:

"This chain reaction is predictable. Over the next 18 months, 4 to 8 states are expected to follow suit, collectively controlling over $1.2 trillion in reserve funds. In the short term, driven by the 'bandwagon effect,' institutional inflows are projected to reach $300 million to $1.5 billion. This is not speculation—it is a game theory practice unfolding in real time."

Currently, states with similar political leanings, such as New Hampshire and Arizona, have enacted Bitcoin reserve-related laws—viewing Bitcoin as a strategic asset to hedge against risks in the global financial system.

More states may join this ranks in the future: with new accounting standards eliminating the previous punitive "mark-to-market" provisions, these states can use structural surplus funds to allocate to Bitcoin, achieving asset diversification.

Moreover, the impact of state governments participating in the Bitcoin market extends far beyond "symbolism." ETF purchases do not alter Bitcoin's circulating supply, as the trust structure does not remove Bitcoin from the liquid market during share issuance and redemption.

In contrast, "direct self-custody" will have the opposite effect: once Bitcoin is purchased and transferred to cold storage, it exits the tradable pool, reducing the supply available to exchanges and market makers.

If Texas expands its Bitcoin reserve beyond the initial $10 million, this difference will have a significant impact. Even if state-level demand is modest, it will introduce an entirely new category of buyers—participants whose behavior is countercyclical to "noise traders" (investors or entities that trade based on irrational factors rather than rational analysis, real market information, or fundamental logic such as corporate earnings or macroeconomic data) and who do not adjust their positions frequently.

This impact will act more as a "stabilizing anchor" than a source of volatility. If other states adopt similar policies, the elasticity of Bitcoin's supply curve will further decrease, and price sensitivity will increase.

## Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice on this platform. This platform makes no representations or warranties regarding the accuracy, completeness, originality, or timeliness of the information contained in the article, nor shall it be liable for any losses arising from the use of or reliance on such information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada