X-trader NEWS

Open your markets potential

2025 Global Transaction Guide: 11 key transactions where politics and markets intersect

# Author: Bloomberg

## Compiled by: Saoirse, Foresight News

This was yet another year defined by **high-conviction bets** and **swift reversals**.

From bond trading desks in Tokyo and credit committees in New York to forex traders in Istanbul, markets delivered windfall gains as well as violent swings. Gold prices hit an all-time record; shares of staid mortgage giants swung wildly like meme stocks (shares driven by social media hype); a textbook arbitrage trade collapsed in an instant.

Investors piled into bets centered on political shifts, bloated balance sheets and fragile market narratives, fueling sharp stock rallies and crowded yield trades. Meanwhile, cryptocurrency strategies relied heavily on leverage and expectations, lacking other solid underpinnings. After Donald Trump returned to the White House, global financial markets first tumbled sharply then rebounded; European defense stocks ignited a buying spree; speculators whipped up one market frenzy after another. Some positions reaped stunning returns, but others crashed spectacularly when market momentum reversed, funding channels dried up or leverage turned sour.

As the year draws to a close, Bloomberg spotlights the most eye-catching trades of 2025 — including success stories, failures and positions that defined the era. These trades leave investors fretting over a familiar set of worries as they brace for 2026: shaky corporates, stretched valuations and trend-chasing trades that “worked until they didn’t”.

### Cryptocurrencies: The Fleeting Frenzy of Trump-Linked Assets

For the cryptocurrency sector, “buying the dip on all Trump-branded assets” seemed like an irresistible momentum bet. During his presidential campaign and after taking office, Trump went “all-in on digital assets” (per Bloomberg Terminal reports), pushing for sweeping reforms and installing industry allies in multiple powerful agencies. His family members also jumped on the bandwagon, endorsing various tokens and crypto firms — moves that traders saw as “political rocket fuel”.

This “Trump crypto-asset matrix” took shape rapidly: hours before his inauguration, Trump launched a meme coin and promoted it on social media; First Lady Melania Trump later rolled out her own exclusive token; later that year, Trump family-linked World Liberty Financial made its WLFI token available for trading to retail investors. A flurry of “Trump-themed” ventures followed — Eric Trump co-founded American Bitcoin, a publicly traded cryptocurrency miner that went public via a merger in September.

In a shop in Hong Kong, there hangs a cartoon portrait of Donald Trump, holding cryptocurrency tokens with the White House in the background, commemorating his inauguration.

Photographer: Paul Yeung / Bloomberg

The launch of each asset triggered a rally, but every surge was fleeting. As of December 23, Trump’s meme coin had performed dismally, plunging over 80% from its January peak; according to data from crypto analytics platform CoinGecko, Melania’s meme coin had crashed nearly 99%; and the share price of American Bitcoin had dropped around 80% from its September high.

Politics provided the tailwind for these trades, yet the laws of speculation ultimately pulled them back to square one. Even with "supporters" in the White House, these assets could not escape the crypto market’s core cycle: price rally → leverage inflow → liquidity crunch. Bitcoin, the sector’s bellwether, is highly likely to log an annual loss this year after falling from its October peak. For Trump-linked assets, politics can generate short-term hype, but it offers no long-term protection.

—— Olga Kharif (Reporter)

### AI Trade: The Next "Big Short"?

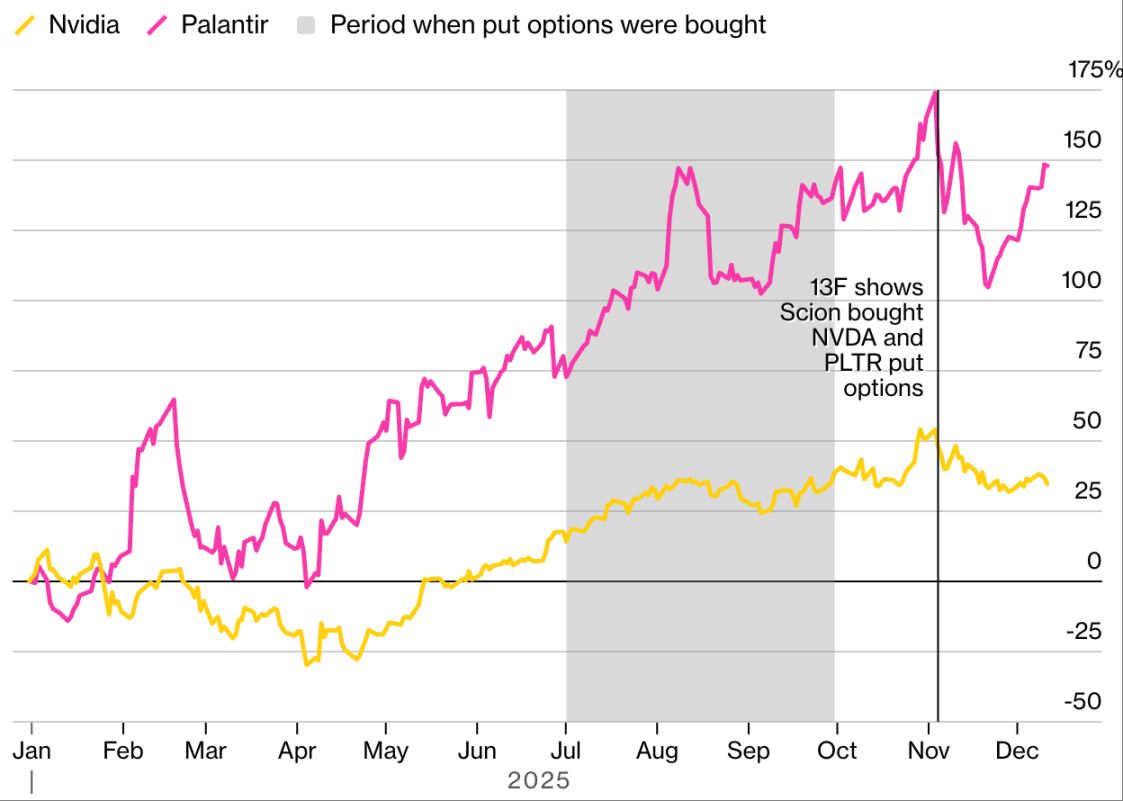

This trade came to light in a routine disclosure filing, but its implications were anything but "routine". On November 3, Scion Asset Management revealed that it held protective put options on **Nvidia** and **Palantir Technologies**—two AI bellwethers that had fueled market gains over the past three years. While Scion is not a large-scale hedge fund, its manager **Michael Burry** made this disclosure a headline-grabber: Burry rose to fame for predicting the 2008 subprime mortgage crisis, as depicted in the book and film *The Big Short*, cementing his reputation as a market soothsayer.

The strike prices of the options were jaw-dropping: the strike price for Nvidia was 47% below the closing price on the day of disclosure, while that for Palantir was a staggering 76% lower. Yet mysteries remain unsolved: constrained by "limited disclosure requirements", the public cannot confirm whether these put options (contracts that grant investors the right to sell stocks at a specified price by a certain date) are part of a more complex trading strategy; what is more, the filing only reflects Scion’s holdings as of September 30, leaving room for the possibility that Burry has since reduced or exited these positions.

Nevertheless, market doubts over the "sky-high valuations and excessive spending" of AI giants had long been piling up like kindling. Burry’s disclosure was like a match that lit the fuse.

### Burry’s Bearish Bet on Nvidia and Palantir

The investor made famous by *The Big Short* disclosed put option holdings in his 13F filing:

**Source**: Bloomberg. Data has been standardized based on percentage gains as of December 31, 2024.

Following the news release, **Nvidia**—the world’s most valuable stock by market capitalization—plunged sharply in response, with **Palantir** falling in tandem and the **Nasdaq Composite** edging lower in a modest pullback. However, all these assets subsequently recouped their losses.

The outside world cannot know for sure how much profit Burry made from the trade, but he left a clue on social media platform **X**: he stated that he had bought Palantir put options at $1.84 each, and these options surged as much as 101% in less than three weeks. This disclosure laid bare the deep-seated doubts lurking beneath a market dominated by a handful of AI stocks, massive passive capital inflows, and low volatility. Whether this trade ultimately proves to be a stroke of **foresight** or a case of **being too hasty**, it underscores an immutable rule: once market conviction wavers, even the most dominant market narratives can reverse course in an instant.

—— Michael P. Regan (Reporter)

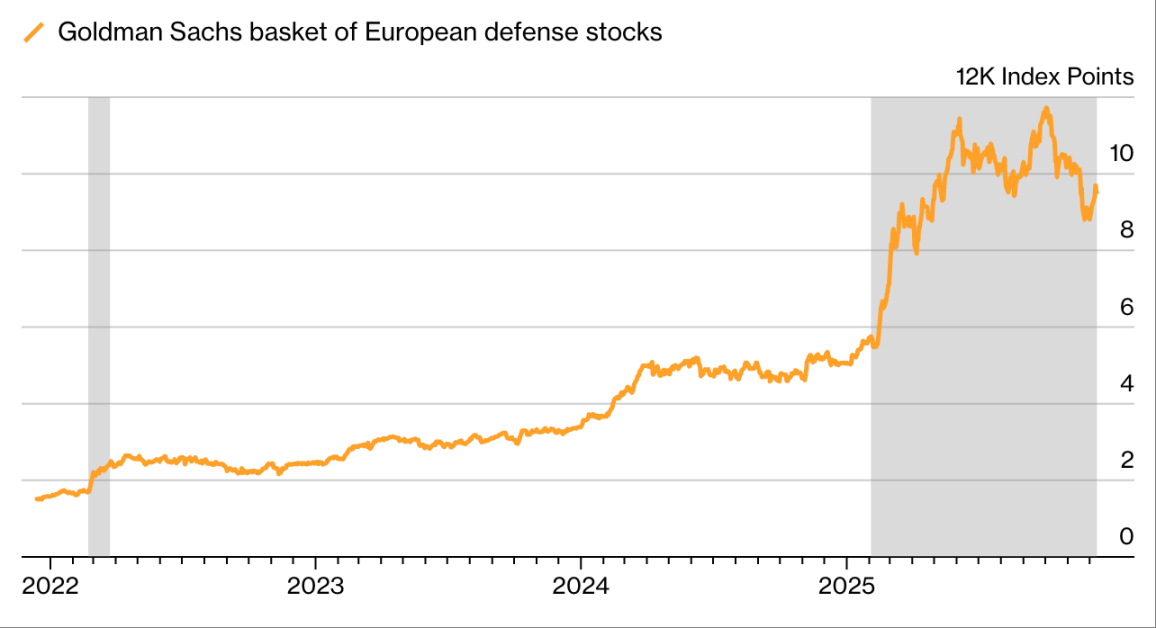

### Defense Stocks: A Boom Amid the New World Order

Shifts in the geopolitical landscape have sparked a rally in **European defense stocks**—a sector once dismissed by asset managers as "toxic assets". Donald Trump’s plan to cut financial support for the Ukrainian military has prompted European governments to embark on a **defense-spending spree**, sending shares of regional defense firms soaring. As of December 23, Germany’s **Rheinmetall AG** has rallied approximately 150% year-to-date, while Italy’s **Leonardo SpA** has surged more than 90% over the same period.

Previously, many fund managers shunned the defense sector as "too controversial" due to Environmental, Social, and Governance (ESG) investment principles. Now, they have made a complete U-turn, with some funds even redefining their investment scope.

#### European Defense Stocks Surge in 2025

The region’s defense stocks have outperformed their gains seen in the early days of the Russia-Ukraine conflict:

# English Translation

Source: Bloomberg, Goldman Sachs Group

“We did not reinclude defense - related assets in our ESG funds until the start of this year,” stated Pierre - Alexis Dumont, Chief Investment Officer of Sycomore Asset Management. “The market paradigm has shifted. Amid such a paradigm shift, we must both fulfill our responsibilities and uphold our values. That is why we are now focusing on assets related to ‘defensive weapons’.”

Stocks with even the slightest links to defense, ranging from goggle manufacturers and chemical producers to a printing company, have been snapped up frantically. As of December 23, the Bloomberg European Defense Index has surged more than 70% year - to - date. This upsurge has also spilled over into the credit market. Even enterprises indirectly connected to defense have attracted a large number of potential lenders. Banks have even launched “European Defense Bonds”, modeled after green bonds but with funds earmarked specifically for entities like arms manufacturers. This shift marks the repositioning of “national defense” from a “reputational liability” to a “public good”, and it also confirms a truth: when geopolitics takes a turn, capital flows often outpace ideological shifts.

—— Isolde MacDonogh (Reporter)

## Devaluation Trade: Fact or Fiction?

The heavy debt burdens of major economies such as the United States, France, and Japan, coupled with the lack of political will among these countries to resolve their debt issues, prompted some investors in 2025 to chase “devaluation - resistant assets” like gold and cryptocurrencies while losing enthusiasm for government bonds and the US dollar. Dubbed a bearish “devaluation trade”, this strategy drew inspiration from history. Rulers such as Roman Emperor Nero once resorted to debasing currency values to tackle fiscal pressures.

In October, this narrative reached a crescendo. Concerns over the US fiscal outlook, combined with the longest - running government shutdown in history, led investors to seek safe - haven assets beyond the US dollar. That month, both gold and Bitcoin hit record highs simultaneously—a rare occurrence for these two assets that are often seen as competitors.

### Gold Records

The “devaluation trade” fueled new highs for precious metals:

Source: Bloomberg

As a narrative, “devaluation” offered a clear explanation for the chaotic macroeconomic environment. However, as an investment strategy, its practical effectiveness proved far more complex. Subsequently, the cryptocurrency market experienced an overall pullback, with Bitcoin plummeting sharply. The US dollar stabilized to some extent, and US Treasury bonds are on track to post their best annual performance since 2020 instead of collapsing. This serves as a reminder that concerns about deteriorating public finances can coexist with demand for safe - haven assets, especially during periods of slowing economic growth and peaking policy rates.

Price movements of other assets have been mixed. Fluctuations in metals like copper, aluminum, and even silver stemmed half from fears of currency devaluation and half from Trump’s tariff policies and other macroeconomic forces, blurring the line between inflation hedges and traditional supply shocks. Meanwhile, gold maintained its strong momentum, continuously setting new record highs. In this sector, the “devaluation trade” remains effective, but it is no longer a full - scale repudiation of fiat currencies; instead, it has evolved into a precise bet on interest rates, policies, and safe - haven demand.

—— Richard Henderson (Reporter)

## South Korean Stock Market: A “K - Pop - Style” Surge

When it comes to dramatic reversals and excitement, the performance of South Korea’s stock market this year can outshine Korean dramas. Driven by President Lee Jae - myung’s policies to boost the capital market, as of December 22, South Korea’s benchmark Kospi index has soared more than 70% in 2025, inching closer to Lee’s 5,000 - point target and easily ranking among the top - performing major global stock indexes for the year.

It is uncommon for political leaders to publicly set a specific stock index level as a target. When Lee first proposed the Kospi 5,000 - point plan, it attracted little attention. Now, an increasing number of Wall Street banks, including JPMorgan Chase and Citigroup, believe this target is likely to be achieved in 2026. This is partly due to the global AI boom, as South Korea’s stock market has seen a surge in demand for its status as a core Asian AI investment destination.

### South Korean Stock Market Rebound

South Korea’s benchmark stock index has skyrocketed:

Source: Bloomberg

Notably absent from this globally leading rally are South Korea’s domestic retail investors. Although Lee often emphasizes to voters that he was a retail investor before entering politics, his reform agenda has yet to convince domestic investors that the stock market is worth holding for the long term. Even as foreign capital floods into South Korea’s stock market, local retail investors have been net sellers. They have poured a record $33 billion into the US stock market and chased higher - risk investments such as cryptocurrencies and overseas leveraged ETFs.

This phenomenon has had an adverse side effect: pressure on the South Korean won. Capital outflows have weakened the currency, a reminder that even a sensational stock market rally can mask lingering doubts among domestic investors.

—— Youkyung Lee (Reporter)

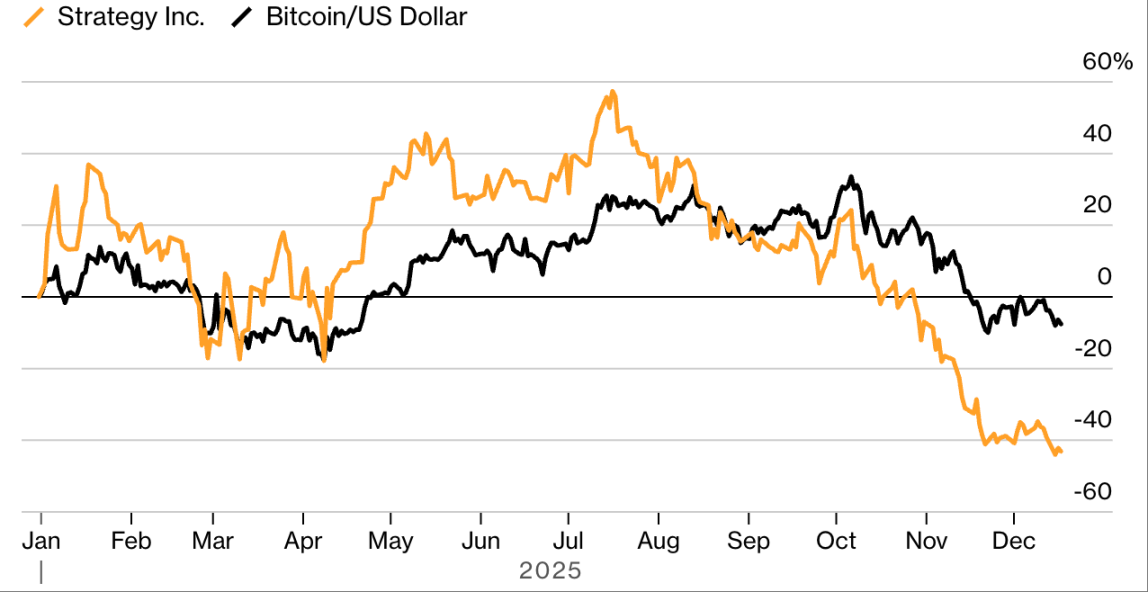

## Bitcoin Showdown: Chanos vs. Saylor

Every story has two sides. The arbitrage showdown between short seller Jim Chanos and Strategy, the firm led by Bitcoin enthusiast Michael Saylor, not only involved two highly distinctive figures but also evolved into a referendum on capitalism in the cryptocurrency era.

At the start of 2025, as Bitcoin prices soared, Strategy’s stock followed suit. Chanos spotted an opportunity: Strategy’s stock traded at an excessive premium relative to its Bitcoin holdings, and the legendary investor deemed this premium unsustainable. He thus decided to short Strategy and go long on Bitcoin, publicly announcing this strategy in May when the premium was still high.

Chanos and Saylor then engaged in a public war of words. In June, Saylor told Bloomberg Television, “I don’t think Chanos has the slightest understanding of our business model.” In response, Chanos fired back on social media platform X, dismissing Saylor’s explanation as complete financial nonsense.

In July, Strategy’s stock hit a record high, with a year - to - date gain of 57%. However, as the number of digital asset treasury companies surged and cryptocurrency prices retreated from their peaks, the stock prices of Strategy and its imitators began to decline, and Strategy’s premium over Bitcoin shrank—Chanos’ bet started to pay off.

### Strategy Underperforms Bitcoin This Year

As Strategy’s premium vanished, Chanos’ short position reaped rewards:

Source: Bloomberg. Data has been standardized based on percentage gains as of December 31, 2024.

Between the time Chanos went public with his short position on Strategy and November 7, when he announced his complete exit, Strategy’s stock price plummeted 42%. Beyond the profits and losses, this case exposed the recurring boom - and - bust cycle of the cryptocurrency industry. Balance sheets expand on the back of confidence, which in turn relies on rising prices and financial engineering to sustain itself. This model works until confidence wavers, at which point the premium transforms from an advantage into a liability.

—— Monique Mulima (Reporter)

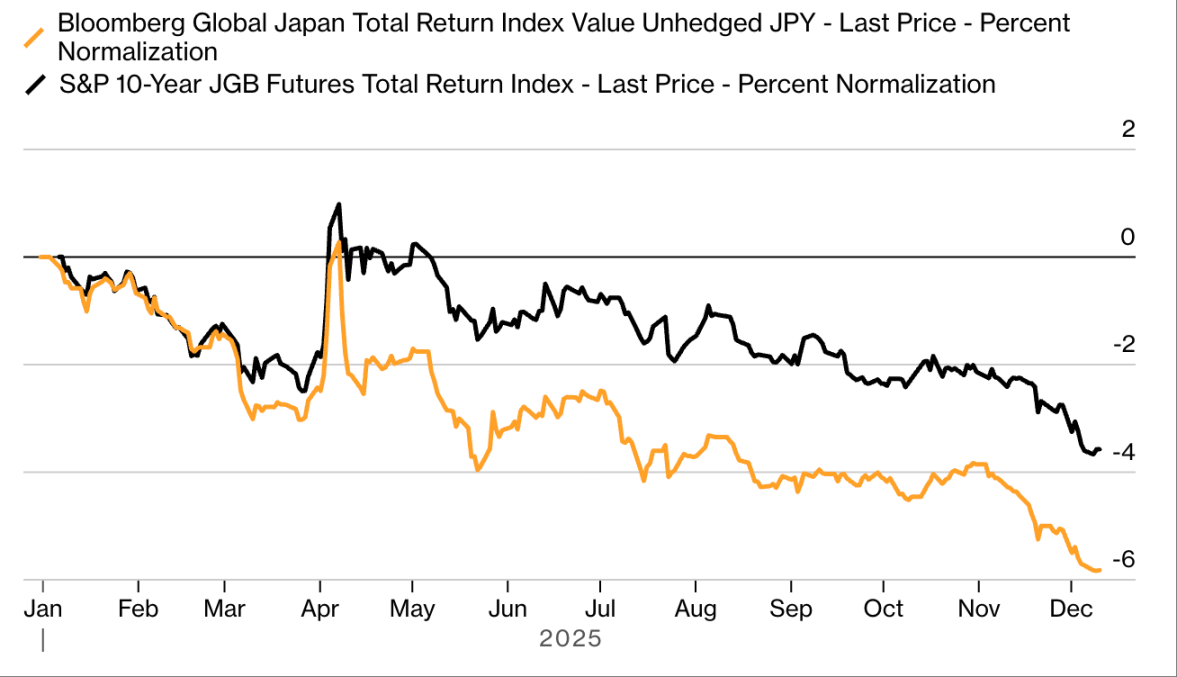

## Japanese Government Bonds: From “Widow - Maker” to “Rainmaker”

Over the past few decades, one bet has repeatedly tripped up macro investors—the short - selling of Japanese government bonds, known as the “widow - maker” trade. The logic behind this strategy seemed straightforward: Japan is burdened with enormous public debt, so interest rates would inevitably rise sooner or later to attract enough buyers. Investors borrowed Japanese government bonds to sell them short, hoping to profit as interest rates climbed and bond prices fell. For years, though, the Bank of Japan’s accommodative policies kept borrowing costs low, inflicting heavy losses on short sellers. That all changed in 2025.

This year, the “widow - maker” trade was transformed into a “rainmaker” trade. Yields on Japan’s benchmark government bonds soared across the board, turning the $7.4 trillion Japanese government bond market into a paradise for short sellers. Multiple factors triggered this shift, including the Bank of Japan’s interest rate hikes and Prime Minister Sanae Takaichi’s launch of the largest post - pandemic spending package. The yield on the benchmark 10 - year Japanese government bond exceeded 2%, a multi - decade high. The 30 - year yield jumped more than 1 percentage point, setting an all - time record. As of December 23, the Bloomberg Japanese Government Bond Return Index has dropped more than 6% this year, making Japan’s bond market the worst - performing major bond market globally.

### Japanese Bond Market Plunges This Year

The Bloomberg Japanese Government Bond Index ranks as the worst - performing major bond index worldwide:

Source: Bloomberg. Data has been standardized based on percentage gains as of December 31, 2024, and January 6, 2025.

Fund managers from institutions including Schroders, Jupiter Asset Management, and RBC BlueBay Asset Management have publicly discussed taking short positions on Japanese government bonds in one form or another this year. Investors and strategists believe there is still room for this trade as the benchmark policy rate rises. Furthermore, the Bank of Japan is scaling back its government bond purchases, which has pushed yields even higher. Japan’s government debt - to - GDP ratio is far ahead of other developed economies, and bearish sentiment toward Japanese government bonds is likely to persist.

—— Cormac Mullen (Reporter)

## Credit Infighting: Rewards of Hardball Tactics

The most lucrative credit returns in 2025 did not come from betting on corporate recovery, but from countering fellow investors. This model, known as creditor - versus - creditor combat, brought resounding victories to institutions such as Pacific Investment Management Company (Pimco) and King Street Capital Management. They orchestrated a precise game plan centered on Envision Healthcare, a healthcare enterprise owned by KKR Group.

After the pandemic, Envision, a hospital staffing service provider, ran into trouble and was in urgent need of loans from new investors. However, issuing new debt required using already pledged assets as collateral. Most creditors joined forces to oppose this plan, while Pimco, King Street Capital Management, and Partners Group defected to support it. Their backing enabled the proposal to pass, under which existing creditors released the pledged assets (equity in Amsurg, Envision’s high - value ambulatory surgery business) to secure the new debt.

The sale of Amsurg to Ascension Health generated substantial returns for funds including Pacific Investment Management Company (Pimco). Photographer: Jeff Adkins.

These institutions then became bondholders secured by Amsurg and ultimately converted their bonds into Amsurg equity. This year, Amsurg was sold to healthcare group Ascension Health for $4 billion. Statistics show that these institutions, which betrayed their peers, reaped returns of approximately 90%, demonstrating the profit potential of credit infighting.

This case reveals the current rules of the credit market: with loose contractual terms and fragmented creditors, cooperation is not a necessity. It is often not enough to make correct judgments; avoiding being outmaneuvered by peers poses an even greater risk.

—— Eliza Ronalds - Hannon (Reporter)

## Fannie Mae and Freddie Mac: Revenge of the “Toxic Twins”

Since the financial crisis, mortgage giants Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) have been under U.S. government conservatorship. The question of when and how they would break free from government control has long been a focus of market speculation. Proponents such as hedge fund manager Bill Ackman have held long - term positions, anticipating huge profits from privatization plans. Nevertheless, the stocks of these two companies have lingered in the doldrums on the Pink Sheets (over - the - counter market) for years due to the unchanged situation.

Trump’s re - election changed this landscape. The market was optimistic that the new administration would push for the two companies to break away from conservatorship, and Fannie Mae and Freddie Mac stocks were immediately swept up in Meme - stock - like enthusiasm. In 2025, the rally gained further momentum. From the start of the year to their peak in September, the stock prices of the two companies soared by 367% (with an intraday surge of 388%), making them among the standout winners of the year.

### Fannie Mae and Freddie Mac Stocks Surge on Privatization Expectations

There is a growing belief that these companies will shake off government control.

Source: Bloomberg. Data has been standardized based on percentage gains as of December 31, 2024.

In August, news that the government was considering promoting IPOs for the two companies sent the rally into overdrive. The market estimated that the IPOs could value the companies at over $500 billion, with plans to sell 5% - 15% of their shares to raise approximately $30 billion. Although the market expressed doubts about the exact timing of the IPOs and whether they would actually materialize, leading to price fluctuations since the September peak, most investors remained confident about this prospect.

In November, Ackman released a proposal submitted to the White House, recommending that Fannie Mae and Freddie Mac be relisted on the New York Stock Exchange. The proposal also called for writing down the preferred stock held by the U.S. Treasury Department in the two companies and exercising government - level options to acquire nearly 80% of their common stock. Even Michael Burry joined this camp. In early December, he announced a bullish stance on the two companies and stated in a 6,000 - word blog post that these enterprises, which once required government bailouts to avoid bankruptcy, might no longer be the “toxic twins”.

—— Felice Maranz (Reporter)

## Turkish Carry Trade: A Total Collapse

After a stellar performance in 2024, the Turkish carry trade became a consensus choice among emerging market investors. At that time, the yield on local Turkish bonds exceeded 40%, and the central bank pledged to maintain a stable U.S. dollar - pegged exchange rate, prompting traders to flood into the trade. They borrowed funds at low costs overseas and invested in high - yielding Turkish assets. This trade attracted billions of dollars in investments from institutions such as Deutsche Bank, Millennium Partners, and Gramercy Funds Management. Some personnel from these institutions were in Turkey on March 19, the day the trade collapsed completely within minutes.

The trigger for the collapse occurred on the morning of that day: Turkish police raided the residence of the popular opposition mayor of Istanbul and detained him. The incident sparked a wave of protests, triggering a frenzy of selling of the Turkish lira, and the central bank was completely powerless to stem the sharp exchange rate decline. Kit Juckes, Head of FX Strategy at Société Générale in Paris, stated at the time, “Everyone was caught off guard, and no one will dare to return to this market anytime soon.”

After the detention of Istanbul Mayor Ekrem İmamoğlu, university students held Turkish flags and slogans during demonstrations. Photographer: Kerem Uzel / Bloomberg.

By the close of trading that day, capital outflows from lira - denominated assets were estimated at approximately $10 billion, and the market never truly recovered afterward. As of December 23, the Turkish lira had depreciated by about 17% against the U.S. dollar for the year, making it one of the worst - performing currencies globally. This incident also served as a wake - up call for investors: high interest rates may bring returns to risk - takers, but they cannot defend against sudden political shocks.

—— Kerim Karakaya (Reporter)

## Bond Market: Cockroach Alert Sounded

The 2025 credit market was not thrown into turmoil by a single spectacular collapse, but was unsettled by a string of small - scale crises that exposed disturbing hidden risks in the market. Companies once regarded as regular borrowers ran into trouble one after another, inflicting heavy losses on lenders.

Saks Global restructured its $2.2 billion bonds after paying interest only once, and the restructured bonds now trade at less than 60% of their face value. The newly issued exchange bonds of New Fortress Energy lost more than 50% of their value within a year. Tricolor and First Brands filed for bankruptcy one after another, erasing billions of dollars in creditor value within weeks. In some cases, complex fraud was the root cause of the companies’ collapses; in others, the companies’ overly optimistic performance expectations never materialized. Regardless of the circumstances, investors were forced to confront a question: with little evidence that these companies were capable of repaying their debts, why did they make large - scale credit bets on them in the first place?

JPMorgan Chase was burned by a credit “cockroach”, and Jamie Dimon warned that there might be more to come. Photographer: Eva Marie Uzcategui / Bloomberg.

Years of low default rates and accommodative monetary policies have eroded various standards in the credit market, ranging from lender protection clauses to basic underwriting processes. Lenders to First Brands and Tricolor failed to detect irregularities such as asset double - pledging and the commingling of collateral for multiple loans at these two companies.

JPMorgan Chase was among these lenders. In October, Jamie Dimon, the bank’s Chief Executive Officer, warned the market and used a vivid metaphor to alert investors to subsequent risks: “When you see one cockroach, there are likely many more hiding in the dark.” This “cockroach risk” is likely to emerge as one of the core themes in the market in 2026.

—— Eliza Ronalds - Hannon (Reporter)

Disclaimer: The views expressed in this article only represent the personal views of the author and do not constitute investment advice from this platform. This platform does not make any guarantees regarding the accuracy, completeness, originality, and timeliness of the information in the article. Nor does it assume any liability for any losses arising from the use of or reliance on the information in the article.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada