Can Bitcoin’s 9.1% increase in July reappear? Before the U.S. stock market closes on the implementation of the

### **1. Market Watch**

The Federal Reserve's monetary policy stands at a complex crossroads influenced by trade tariffs. Chair **Jerome Powell** admitted that **without the Trump administration's tariff plans potentially undermining inflation control efforts**, the Fed might have already cut rates. While keeping all options open for July, his remarks suggest **increasing policy flexibility**, with the bar for rate cuts likely lowering if employment data weakens.

Meanwhile, U.S. fiscal policy adds another layer of uncertainty. The high-stakes **"Big & Beautiful" tax and spending bill** narrowly passed the Senate **51-50**, with the House set to debate and vote on the Senate version **this Wednesday**. Trump hopes to sign it into law before **July 4 (Independence Day)**. The bill—featuring **tax cuts, reduced social safety net spending, and increased military/immigration enforcement budgets**—is projected to add **$3.3 trillion to U.S. debt over the next decade**.

On the trade front, **Trump remains uncompromising**, refusing to delay the **July 9 tariff deadline** and singling out **Japan** for pressure, escalating global market tensions. Notably, U.S. markets will **close early at 1:00 AM Beijing time on July 4** and remain shut all day for the holiday, entering a brief lull before the policy storm.

---

### **Hong Kong’s Web3 Milestone**

Yesterday marked **Hong Kong’s 28th anniversary since its handover**, coinciding with the launch of **HashKey Exchange’s** first offline exhibition booth at **West Kowloon High-Speed Rail Station**—the city’s **first licensed virtual asset exchange**. **Jeffrey Ding**, HashKey’s chief analyst, stated that **Web3 represents not just technological evolution but a paradigm shift in efficiency and trust**.

2025 is seen as a pivotal year for Hong Kong to redefine itself through **digital sovereignty and institutional innovation**. With blockchain efficiency gains and accelerating institutionalization of digital assets, Hong Kong is poised to **lead the new global financial order**.

---

### **Bitcoin Correction Looms?**

Bitcoin dipped to **$105K** this morning, with **Bitfinex analysts** flagging **weakening momentum**—signaling a potential consolidation or local top. Declining spot volumes and profit-taking are in focus, with **short-term holder cost basis ($98.7K)** acting as key support.

Historically, **Q3 is Bitcoin’s weakest quarter** (avg. return: **6%**), suggesting subdued volatility ahead. Yet **Matrixport data** shows BTC has risen in **7 of the past 10 Julys** (avg. gain: **9.1%**), supporting bullish bets on a push toward **$116K**.

However, bearish analyst **CryptoCapo** warns the **"real sell-off hasn’t started"**, predicting a drop to **$92K–$93K**, with a potential bottom at **$60K–$70K**. If realized, altcoins could face **50%–80% declines**.

---

### **On-Chain Trends: Stocks Outshine Memecoins**

The on-chain market remains sluggish, with no breakout memecoins. However, **Robinhood and xStocks’ stock tokenization wave** is gaining traction:

- **Robinhood’s stock hit an all-time high ($99.18)**, reviving Solana-based memecoin **$STOCKCOIN** (market cap **surged 1,400% in 24H** to **$4.4M**).

---

### **2. Key Data (as of July 2, 12:00 HKT)**

*(Sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)*

- **Bitcoin**: $106,465 (**+13.8% YTD**), daily spot volume: **$26.06B**

- **Ethereum**: $2,439.94 (**-26.88% YTD**), daily spot volume: **$14.38B**

- **Fear & Greed Index**: 63 (Greed)

- **Avg. Gas Fees**: BTC **2 sat/vB**, ETH **0.7 Gwei**

- **Market Dominance**: BTC **64.6%**, ETH **9.0%**

- **Top Upbit Traders (24H)**: STMX, XRP, CBK, BTC, PENGU

- **BTC Long/Short Ratio**: 1.1186

- **Sector Moves**: AI (**-4.48%**), RWA (**-4.72%**)

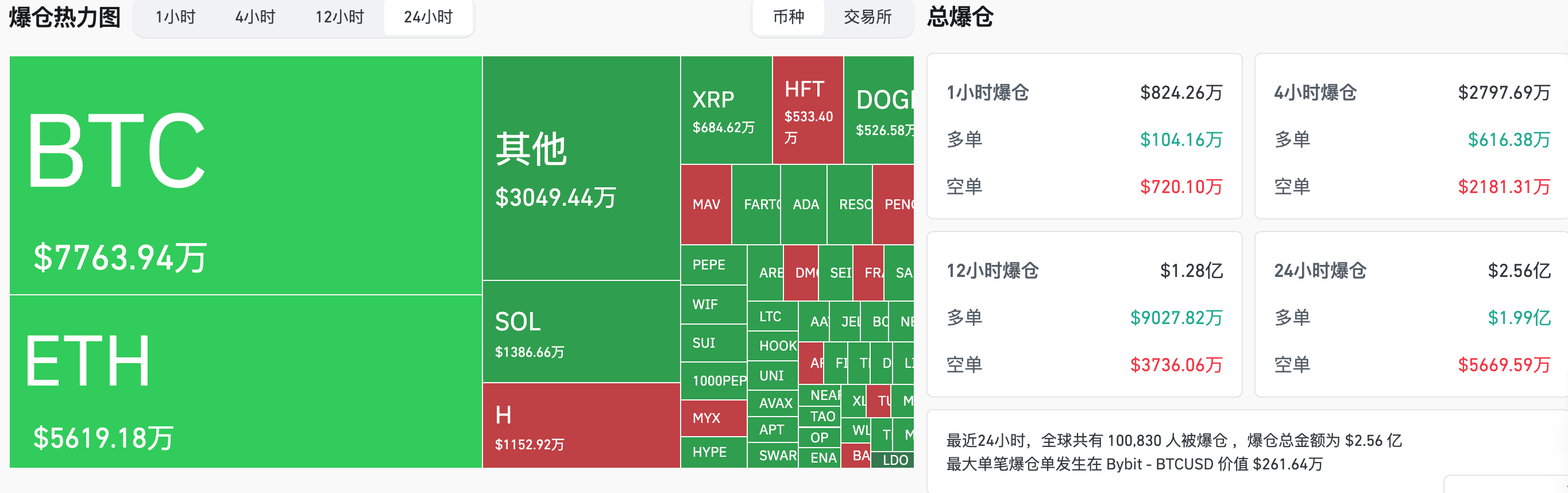

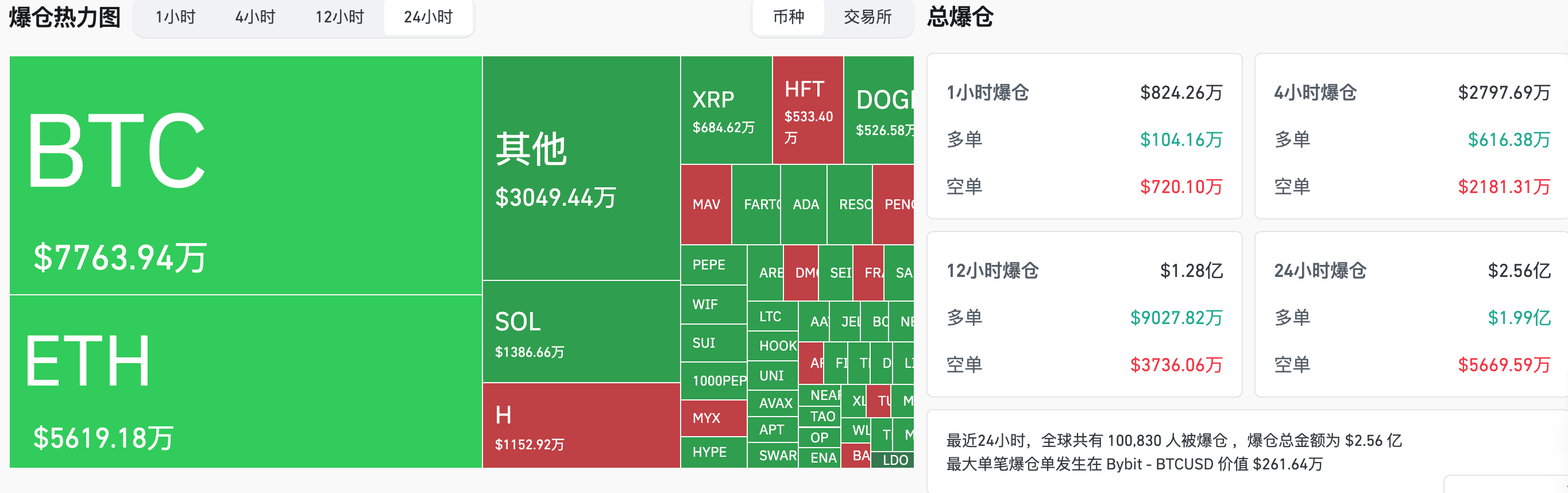

- **Liquidations (24H)**: **100,830 traders**, **$256M total**

- BTC: **$77.64M**, ETH: **$56.19M**, SOL: **$13.87M**

#### **Trend Channels**

- **BTC**: Upper bound (**$107,151.13**), Lower bound (**$105,029.32**)

- **ETH**: Upper bound (**$2,467.39**), Lower bound (**$2,418.53**)

*Note: Prices above upper/lower bounds indicate bullish/bearish trends; sideways movement suggests accumulation/distribution.*

**Disclaimer**: This content reflects the author’s views only and does not constitute investment advice. No guarantees are made regarding accuracy, timeliness, or completeness.

### **3. ETF Fund Flows (as of July 1)**

- **Bitcoin ETFs**: **-$342M** (ending a 15-day net inflow streak)

- **Ethereum ETFs**: **+$40.68M** (3 consecutive days of net inflows)

### **4. Today's Key Events**

#### **Market Closures (U.S. Independence Day)**

- **U.S. stocks** will **close early (3 hours ahead) on July 3** (1:00 AM Beijing Time, July 4).

- **Full-day closure on July 4**.

#### **Crypto Listings & Launches**

- **Binance Alpha** lists **Echo Protocol ($ECHO)** (July 2).

- **Coinbase** adds **Wormhole ($W)**.

- **Rex-Osprey Solana Staking ETF** expected to launch (July 2).

- **OKX** delists **$NC, $SLERF, $KNC, $ALPHA** USDT perpetual contracts (July 4, 16:00 HKT).

#### **Economic Data (U.S.)**

- **June ADP Employment Change**: **Prev. 37K, Exp. 95K** (July 2, 20:15 HKT).

- **June Unemployment Rate**: **Prev. 4.2%, Exp. 4.3%** (July 3, 20:30 HKT).

- **June Non-Farm Payrolls (NFP)**: **Prev. 139K, Exp. 110K** (July 3, 20:30 HKT).

#### **Token Unlocks**

- **Ethena ($ENA)**: **~40.6M tokens (0.67% of circ. supply, ~$10.7M)** unlocked at 15:00 HKT (July 2).

#### **Top Gainers (Top 500 by Market Cap)**

1. **Humanity Protocol ($H)**: **+106.52%**

2. **Cobak Token ($CBK)**: **+50.90%**

3. **Useless Coin ($USELESS)**: **+24.89%**

4. **Quantum Resistant Ledger ($QRL)**: **+17.70%**

5. **Aleo ($ALEO)**: **+16.68%**

*(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)*

Disclaimer: The views expressed in this article only represent the personal views of the author and do not constitute investment advice from this platform. This platform does not make any guarantees regarding the accuracy, completeness, originality, and timeliness of the information in the article. Nor does it assume any liability for any losses arising from the use of or reliance on the information in the article.