Bitcoin breaks through $112,000 for the first time, and institutional demand drives risky assets to rise across the board

Source: Wall Street News

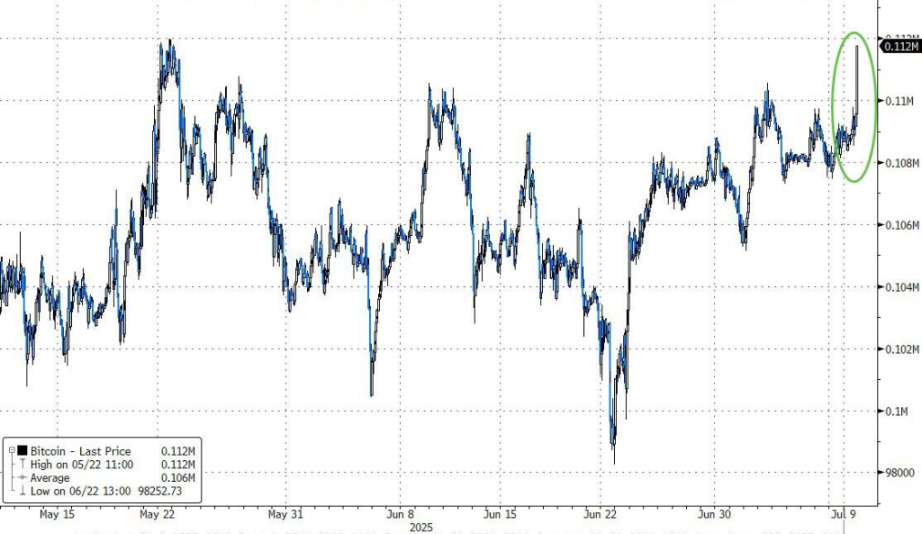

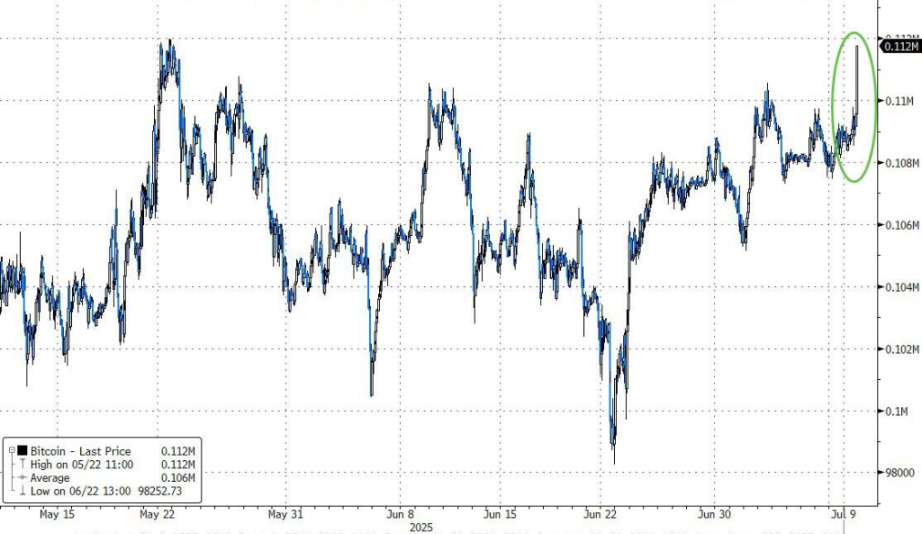

Bitcoin price exceeded $112,000 for the first time, a record high. This milestone breakthrough reflects the current high speculative sentiment in the market, and the continued influx of institutional funds to drive the entire risk asset sector to rise across the board.

At the end of New York trading on July 9, Bitcoin's trend suddenly exerted its strength, breaking through the $110,000 mark and the May 22 high, hitting a high of $112,009, an increase of 3.1%, bringing its cumulative increase this year to nearly 20%.

Analysts believe that the demand for traditional financial tools such as ETFs is reshaping the Bitcoin market structure. Unlike the past that mainly relies on retail investors, the institutional capital inflows behind this round of rises show structural characteristics. Data from cryptocurrency trading company GSR shows that institutional investors continue to buy Bitcoin through various financial instruments, a demand model that is more stable than historical speculative buying.

Adam Guren, chief investment officer of Hunting Hill, noted that Bitcoin’s breakthrough of $112,000 reflects the compound effects of ETF capital inflows, rising institutional adoption rates and favorable macro environments:

Unlike previous cycles, the current demand is structural, regulated and sticky.

Short-term options show optimism, and the macro environment provides support

Derivative market data further confirms the market's optimistic expectations.

On cryptocurrency exchanges, call options that expired at the end of July showed higher open contract volumes at the $115,000 and $120,000 strike prices.

Vincent Liu, chief investment officer of cryptocurrency trading firm, said traders were wary of potential profit-taking or macroeconomic changes that could trigger a pullback, but the trend is firmly bullish.

In addition, according to media reports, the current macroeconomic environment provides favorable conditions for risky assets such as Bitcoin. Rising global political instability, coupled with the resurgence of market expectations for interest rate cuts, has prompted investors to seek hard asset allocation.

Analysts pointed out that Bitcoin is benefiting from two dimensions: it not only acquires a safe-haven asset positioning similar to gold, but also enjoys the momentum brought by rising risk appetite. This dual attribute makes it stand out in the current market environment.

Although the Trump administration announced a new round of tariff measures, speculation still dominated the market. Nvidia once broke through the $4 trillion market value and technology stocks generally rose, providing a good market atmosphere for risky assets, including Bitcoin.

Disclaimer: The views in this article only represent the author's personal views and do not constitute investment advice of this platform. This platform does not make any guarantees for the accuracy, completeness, originality and timeliness of article information, nor is it liable for any losses caused by the use or trust in article information.