X-trader NEWS

Open your markets potential

JD.com recruits DeFi experts: Stablecoins are just the tip of the iceberg, PayFi is the blueprint of the deep sea

A recruitment advertisement can sometimes reveal a company's strategic intentions more than an annual financial report.

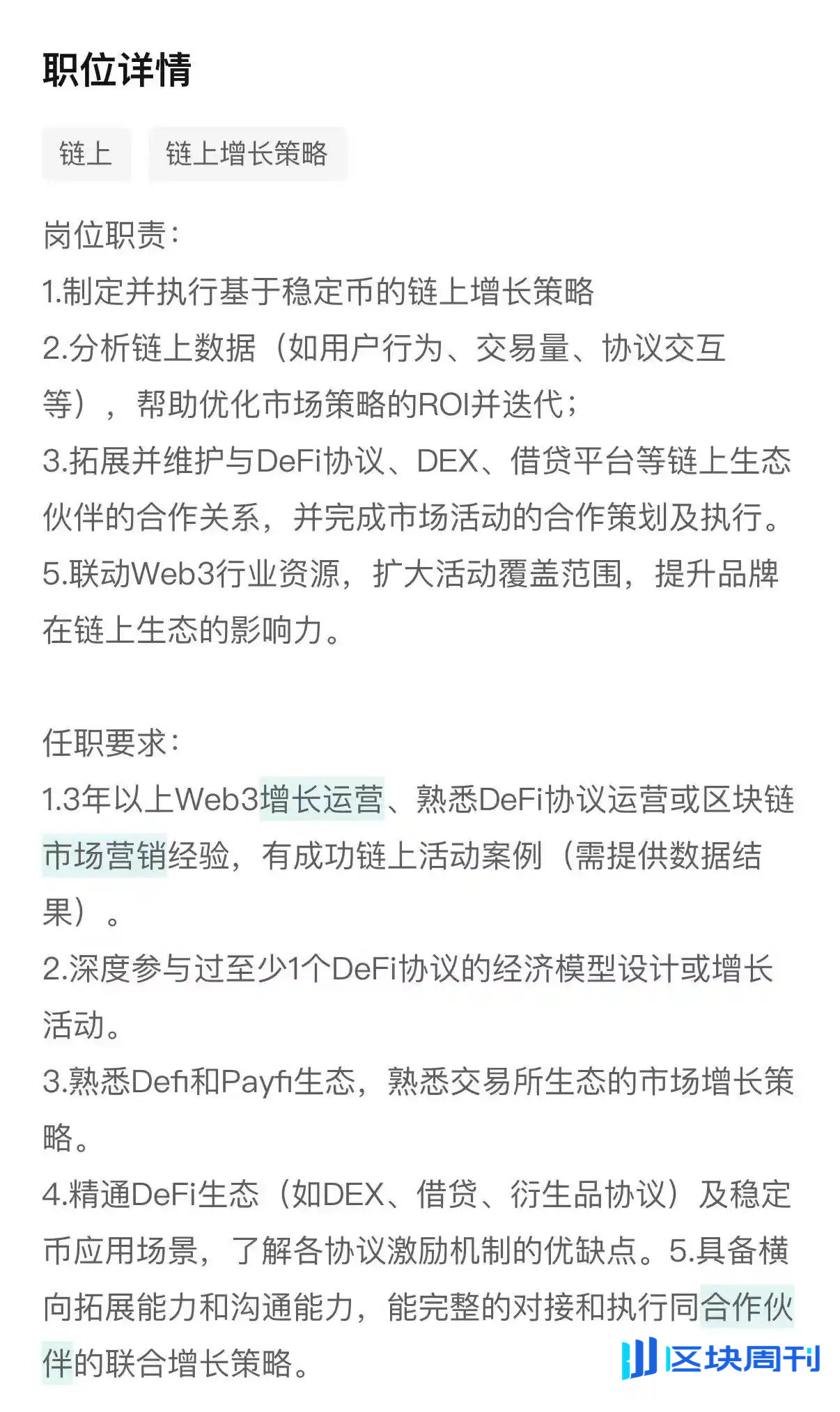

In August 2025, a recruitment notice from JD Technology was just such a case. It did not appear on the homepage of mainstream recruitment websites but quietly circulated in small Web3 circles. What was striking was not the job title "Stablecoin On-Chain Activity Planner" itself, but its "crypto-native" job requirements: "Deep participation in the economic model design of at least one DeFi protocol" and "Proficiency in DEX, lending, and derivative protocols".

Hong Kong

This is not about finding a fintech expert to optimize internal payments, but about "hunting" a true on-chain strategist. When an internet giant with annual revenue exceeding one trillion yuan, rooted in physical retail and supply chains, begins to publicly seek talents who can excel in the decentralized world, the signal it sends is clear: JD is preparing to place its pieces on the global, permissionless Web3 chessboard.

Hong Kong's "favorable wind" has arrived, and JD is seizing the opportunity to enter the game

JD's move did not happen in a vacuum. The timing of the recruitment coincides precisely with a key regulatory change in Hong Kong.

Just a few days before the recruitment information emerged — on August 1, 2025, Hong Kong's long-awaited "Stablecoin Issuer Licensing Regime" officially came into effect. This means that after multiple rounds of consultations and sandbox tests, the Hong Kong Monetary Authority (HKMA) has laid out a compliant and clearly regulated "welcome mat" for global stablecoin operators. Therefore, JD's "recruitment drive" is not so much an exploration into unknown territory as a precisely calculated move, targeting this newly officially recognized global financial frontier with great strategic value.

Xu Zhengyu, Secretary for Financial Services and the Treasury of Hong Kong, has emphasized on many public occasions: "On the premise of ensuring regulation and controllable risks, we support the prudent development of the virtual asset market and regard stablecoins as a key bridge connecting traditional finance and the virtual asset market."

This favorable wind comes at the right time for technology companies like JD, which have a huge mainland China background and are eager to connect with the global market. It provides a perfect "outlet" — a strategically pivotal point with clear legal status, geographical proximity, and cultural affinity. By establishing a compliant entity in Hong Kong, JD can legally issue stablecoins pegged to fiat currencies (such as offshore RMB CNH or Hong Kong dollar HKD), thereby bypassing the strict regulation of cryptocurrencies in mainland China and directly participating in global on-chain economic activities.

The release of JD's recruitment notice right after the regulation took effect is no coincidence, but a long-planned "seizing the opportunity". The chessboard is ready, and JD clearly does not want to be just a spectator.

PayFi: "Financial Lego" Beyond Payments

If Hong Kong's compliant environment is the "timely opportunity" for JD's stablecoin project, then an unremarkable term in the job description — PayFi — reveals its true "geographical advantage" and core ambition.

PayFi, short for Payment Finance, is a concept originating from the crypto-native world. It is far more than just "paying with cryptocurrencies"; its core is to seamlessly integrate payment behavior itself with complex financial services through smart contracts, endowing each flow of funds with programmability.

Imagine a scenario in JD's business: a small and medium-sized enterprise supplying goods to JD used to wait up to 90 days to receive payment, facing huge capital pressure. What would happen under the PayFi model?

After JD confirms receipt of goods, the system can generate an on-chain certificate (NFT or fungible token) representing this accounts receivable and immediately send it to the supplier. Instead of waiting 90 days, the supplier can immediately use this "digital draft" as collateral in a DeFi lending protocol to obtain instant liquidity; or it can even be split, traded, and used as payment to upstream raw material suppliers. The entire process is automatically executed by code, efficient, transparent, and with extremely low costs.

This is precisely the power of combining Real World Assets (RWA) tokenization with PayFi, and it is one of the most exciting narratives in the crypto industry in 2025. Jenny Johnson, CEO of asset management giant Franklin Templeton, once asserted: "We believe that tokenizing real-world assets will reshape the entire financial services industry. This is one of the most significant applications of blockchain technology."

For JD, which has a vast number of merchants, a complex supply chain network, and hundreds of millions of users, it contains trillions of yuan worth of "real-world assets" — accounts receivable, warehouse receipts, logistics orders, and consumer credit. Activating these assets on-chain through stablecoins and PayFi is equivalent to unblocking the whole body's meridians, and the energy it can release will be exponential. This is not only about reducing costs and increasing efficiency in existing supply chain finance businesses but also creating a new, programmable financial infrastructure.

"Amphibious Operations": Different Web3 Paths of Giants

JD's clear orientation towards stablecoins and DeFi has also made it take a completely different path in the Web3 exploration of Chinese technology giants. If we make a horizontal comparison, we will find an interesting picture:

Hong Kong

As shown in the table above, Ant Group, owned by Alibaba, is more like a "water seller" in its Web3 layout. Its ZAN brand launched in Hong Kong focuses on providing compliant technical components such as e-KYC (electronic identity verification), AML (anti-money laundering), and BaaS (Blockchain as a Service) for Web3 developers. Its strategy is to "empower" and help others "pan for gold" rather than enter the fray itself. The recent news that its proprietary chain plans to integrate the US dollar stablecoin USDC also confirms its tendency to cooperate with mature ecosystems rather than start anew.

Tencent is more cautious, with most of its moves focusing on areas clearly defined by domestic policies such as alliance chains and digital collectibles, keeping a considerable distance from the public chain world.

Against this background, JD's strategy seems particularly unique and aggressive. It is not content with being just a technical service provider but has chosen a path of "amphibious operations":

Domestically (Inland): Its self-developed "Zhizhen Chain" continues to delve into industrial blockchain in a licensed environment, serving anti-counterfeiting traceability, digital certification, etc., embracing regulation, connecting with digital RMB (e-CNY), and strengthening the compliant "industrial digitization" base.

Internationally (Offshore): Taking advantage of Hong Kong's window, it personally steps into the arena as a "player", issuing its own stablecoins, operating its own on-chain ecosystem, directly fishing in the ocean of DeFi, and exploring the vast universe of "financial assetization".

This two-pronged strategy not only ensures the stability and compliance of domestic business but also opens up unlimited imagination for the group's future.

From E-commerce Empire to On-Chain Economy

JD's this step marks an important turning point. It indicates that the integration of top Web2 giants and Web3 is moving from theoretical discussions and marginal trials to in-depth integration of core businesses.

In the past, people always discussed how Web3 would "subvert" Web2. But JD's case may reveal another possibility: not subversion, but "upgrading". Web2 giants will not be easily replaced; they will use their huge user base, rich application scenarios, and strong capital to absorb Web3 technologies and concepts and evolve into a new, more powerful hybrid form.

Of course, the road ahead is not smooth. From recruiting a position to truly building a prosperous on-chain ecosystem, JD needs to overcome multiple obstacles such as technology integration, financial compliance, market education, and user habits. It will face not only the scrutiny of traditional financial institutions but also fierce competition from the crypto-native world.

But in any case, when JD, this trillion-level commercial aircraft carrier, begins to adjust its course and sail into the deep waters of DeFi, the entire industry should pay close attention. Because this is not just about the future of a company, but may also depict a blueprint for us: how an e-commerce empire can eventually evolve into an efficient, transparent, and global on-chain economy through the bridge of stablecoins. On that day, the end of a transaction will no longer be the completion of payment, but the beginning of another phase of financial value creation.

Disclaimer: The views in this article solely represent the author's personal opinions and do not constitute investment advice for this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume responsibility for any losses arising from the use of or reliance on the information contained herein.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada