X-trader NEWS

Open your markets potential

The rise and risks of Bitcoin treasury companies

# The Era of Treasury Companies Is Here

By Charles Edwards, Founder of Macro Hedge Fund Capriole Investments

Compiled by Jinse Finance

The era of treasury companies has arrived. Today, more than 150 listed companies around the world have declared themselves Bitcoin treasury companies, and they are sparing no effort to raise capital—with the sole purpose of buying more Bitcoin.

On average, they purchase $300 million worth of Bitcoin from the market every single day. This pace is so rapid that Bitcoin treasury companies now hold 5% of Bitcoin’s total supply, which is valued at $111 billion.

Moreover, this trend is not limited to Bitcoin; it has also spread to Ethereum (accounting for 3.4% of its supply) and a large number of other altcoins, such as Ethena (ENA) and Tensor (TAO). How did we reach this point? Why do dozens of companies go all-in on Bitcoin every month? How far can the era of treasury companies go?

## Chart: Bitcoin Treasury Companies Hold 5% of Total Supply

Over the past two years, the adoption of Bitcoin treasuries by listed companies worldwide has grown exponentially. Currently, more than 150 companies are actively purchasing Bitcoin.

Source: Capriole Charts

## The Success Story of Strategy

MicroStrategy (now renamed "Strategy," stock ticker: MSTR) adopted Bitcoin in August 2020. Initially, this was merely a measure to counter the massive inflation triggered by the U.S. printing trillions of dollars to cover deficits during the COVID-19 pandemic. Soon after, Michael Saylor (CEO of Strategy) went all-in. He raised capital at all costs through debt and equity issuances, with the only goal of buying Bitcoin. Before long, Strategy’s original business disappeared from its homepage, becoming a distant supporting element to its new "Bitcoin-only" model. As Bitcoin soared from $10,000 to $60,000 at the end of 2020, MSTR’s stock price surged by 800%. Saylor raised billions of dollars, effectively tapping into the low cost of capital in traditional financial markets and making leveraged investments in Bitcoin—the asset with the highest returns of our generation.

## MicroStrategy’s Stock Price Surge

Since adopting Bitcoin, MSTR’s stock price has soared by more than 2,500%, and it now holds 3% of Bitcoin’s final total supply.

Source: Capriole Charts

## The Legend of Michael Saylor

Michael Saylor’s technology company had been struggling since the burst of the dot-com bubble. However, thanks to his strong conviction in Bitcoin, sharp insights, and remarkable ability to break down complex issues and explain Bitcoin’s value proposition in digestible segments, he became an instant star in the Bitcoin ecosystem. He has become the public face of Bitcoin. Some of his famous quotes include: "Laura, it’s going to keep rising forever" (2021) and "How many chairs are you sitting on right now? Are you all-in on chairs?" (2023)—statements he used to argue for his belief in Bitcoin and the rationale for not needing diversification. By 2025, Saylor had become a meme. Every day, he posts AI-generated images of himself across all time periods and historical contexts on X.com. He has even portrayed himself as a floating monk.

## Michael Saylor’s Meme Persona on Social Media

Michael Saylor has become a meme on social media.

Source: X.com

While entertaining, Saylor’s meme status is a key factor behind Strategy’s success. We live in a world where valueless tokens and stocks can skyrocket driven by community-led movements, which are often centered around memes. Think of GameStop (2020: +2,000%), Dogecoin (2021: +10,000%), AMC (2021: +300%), Shiba Inu (2021: millions of percent increase), Pepecoin (2023: +20,000%), and dozens of other examples. Today, there are more than 4,000 meme coins with a total market capitalization of $66 billion—assets backed by nothing but an image and a community. People love communities and need a reason to collectively support an idea.

Is this really surprising in a digital world with an annual monetary inflation rate of 10%?

If an idea is compelling and enduring, it can attract billions of dollars in capital at an astonishing speed. Michael Saylor’s near-zealous conviction and cartoonish persona check many of these boxes.

Saylor’s meme status is a key part of his ability to attract capital and instill belief and confidence in the public, but it is only a small component of his $100 billion Strategy empire. How did he manage to achieve this?

## The Secret to Strategy’s Success

Ultimately, it all boils down to arbitrage. Bitcoin has an average annualized return of 30-50%, while the cost of debt and equity Saylor uses to acquire Bitcoin is typically 0-5% per year. His debt instruments usually have a maturity period of 5 years, so as long as Bitcoin maintains a high growth rate and Saylor does not overleverage, he can withstand brutal Bitcoin bear markets and win in the long-term arbitrage game. He has used almost every possible method to raise funds, including issuing stocks, debt, convertible bonds, and warrants, as well as structuring various transactions to obtain capital at low costs. Saylor has also uniquely met market demand by catering to the yield-hungry fixed-income market and providing them with a way to gain substantial Bitcoin returns.

In addition to building a cult-like following of investors around his meme persona, Saylor has proven several things over the past five years:

- **Unwavering conviction**: Unlike many in the industry, Michael has clearly stated and (so far) adhered to his promise to "never sell" Bitcoin. Over the years, he has given investors confidence in Strategy, its roadmap, and expected future actions. This has built trust in the investment community, eliminated much uncertainty, and unlocked billions of dollars in capital for him.

- **Ability to weather storms**: Michael survived the brutal 80% bear market in 2022, as well as numerous industry frauds and bankruptcies. Strategy’s Bitcoin holdings were once underwater (in a floating loss), but Saylor did not waver, sell, or get "liquidated" (as many speculated he might). Saylor proved that he can withstand the volatility of Bitcoin. He demonstrated his ability to manage risks and implement his Bitcoin strategy over the long term. This test of survival has added significant credibility to Strategy and Saylor’s innovative Bitcoin treasury model.

I have great respect for Michael Saylor. When he launched his Bitcoin strategy in 2020, I remember walking with my wife (then fiancée) in Boxhagener Platz, Berlin, and saying that this was a genius move that would bring huge returns to MicroStrategy. Especially at that time, Bitcoin was severely undervalued, and we were in the midst of the largest monetary inflation in history.

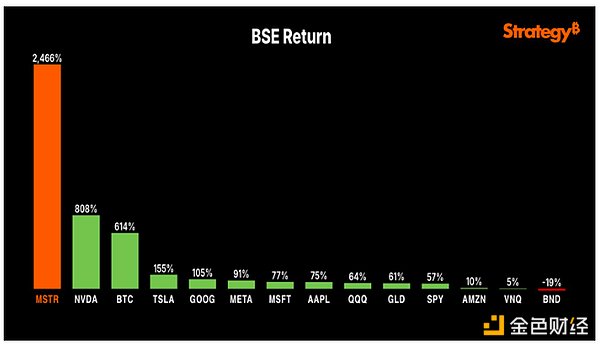

Fast forward five years, and since 2020, Strategy has outperformed the S&P 500 Index, all asset classes, and all stocks in the "Magnificent 7"—including the renowned Nvidia.

## MicroStrategy Outperforms the S&P 500 and the Magnificent 7

Since adopting Bitcoin in 2020, MicroStrategy has outperformed the S&P 500 Index and all members of the "Magnificent 7."

Source: X.com

Given Strategy’s tremendous success and Saylor’s rising fame, it is no surprise that many imitators have flocked to this field. Where there is success, imitation follows. After the 2008 financial crisis, Warren Buffett made an incisive comment that may serve as a good warning for today’s crypto industry: "First come the innovators. Then come the imitators. Then come the fools… People don’t get any smarter when it comes to something as basic as greed."

## The Inevitable Narrative of an Era

Strategy is a story of success and motivation. However, a series of other events have pushed Bitcoin treasury companies into the spotlight and driven their rapid rise, with two specific factors that cannot be ignored: (1) rising global liquidity and (2) significant policy and regulatory drivers.

### 1. Rising Global Liquidity

Bitcoin rises when net liquidity is positive. Capriole’s net liquidity metric—calculated by subtracting the cost of capital (10-year interest rate) from the year-on-year growth of global broad M3 money supply—measures whether global markets are in a phase of liquidity expansion or contraction. In simple terms: when more money is injected into the system at a rate that exceeds the cost of debt capital, market participants tend to channel this fiat currency into assets such as stocks, Bitcoin, gold, and real estate. All historical Bitcoin bear markets have occurred during periods of decline in this indicator, and the lowest points of all deep bear markets have coincided with the indicator falling below zero (red zone). All historical exponential price increases of Bitcoin have occurred during phases of net liquidity expansion (green zone).

After spending most of the past few years in the red zone, net liquidity began to grow in the middle of 2024 and accelerated again in the first quarter of 2025. This net growth in the money supply—fuel for Bitcoin—started just before the Bitcoin treasury company model began to take off.

## Bitcoin Performs Well When Global Monetary Supply Net Liquidity Is Positive

The recent growth has also coincided with the takeoff of treasury companies.

Source: Capriole Charts

### 2. Significant Policy and Regulatory Drivers

With Trump’s inauguration, the U.S. transitioned from an anti-Bitcoin administration to a pro-Bitcoin one. Under the previous administration, U.S. banking access for crypto businesses and funds was targeted in "Operation Choke Point 2.0" in 2023 and 2024, but this effort has now finally been shut down. Over the past year, however, we have gradually seen a dramatic positive shift toward a pro-Bitcoin and pro-digital asset administration, which has given institutions the confidence to invest in Bitcoin and treasury companies:

1. January 2024: The U.S. SEC approves all 11 Bitcoin ETFs.

2. January 2025: Gary Gensler, the anti-crypto SEC Chair, resigns.

3. March 2025: Trump establishes the U.S. Strategic Bitcoin Reserve.

4. March 2025: The White House formally terminates "Operation Choke Point 2.0" and reopens U.S. banking access for the crypto industry.

5. May 2025: The SEC drops its anti-crypto lawsuits against companies such as Ripple and Binance.

6. July 2025: The GENIUS Act provides a sound regulatory framework for stablecoins.

7. August 2025: 401(k) pension plans are approved to purchase Bitcoin, opening a $10 trillion market to digital assets.

All the above measures have provided the regulatory certainty sought by banks, institutional allocators, and investors. Collectively, these actions have reduced industry risks and allowed capital to flow into Bitcoin and digital assets at a lightning-fast pace in 2025—driving the takeoff of Bitcoin treasury companies this year.

## Fuel Ready, Spark Ignited

Over the past six months, the convergence of rising global liquidity, policy green lights, and a proven corporate strategy has created the conditions for a reflexive flywheel to take off for digital asset treasury companies. For these reasons, investors have pushed up the stock prices of treasury companies. Capital markets have opened their doors wide. Higher prices have led to higher valuation multiples for treasury companies; in turn, this has enabled more equity issuances and more purchases of Bitcoin (and other digital assets).

A powerful flywheel that accelerates the adoption of digital asset treasury companies has emerged.

## The Most Important Chart

If we had to choose just one data point to track the impact of Bitcoin treasury companies, it would be the chart below showing institutional purchases as a percentage of Bitcoin’s market capitalization. Today, institutions are purchasing more than 400% of Bitcoin’s daily new mining supply. When demand far outpaces supply like this, Bitcoin has historically soared in the following months. In fact, every time this has happened in Bitcoin’s history (five times in total), the price has risen by an average of 135%.

This indicator is not only important for predicting Bitcoin’s future price but also for monitoring potential risks arising from changes in market sentiment toward the digital asset treasury companies themselves.

## Institutional Bitcoin Purchases vs. Mining Supply

Today, institutions—driven primarily by treasury companies—are purchasing 400% of Bitcoin’s daily mining supply.

Source: Capriole Investments

## A House of Cards (A Fragile System)

Digital asset treasury companies are not without risks. There are two major risks worth exploring to understand where this market might go next.

### 1. Deleveraging

The most obvious risk for treasury companies is excessive leverage caused by overusing debt. Bitcoin is known for its historically high volatility and 80% plunges every 3-4 years. While we expect Bitcoin’s volatility to continue decreasing in the coming years (as it has every year so far), treasury companies must structure their debt and collateral requirements to prepare for the worst-case scenario.

Even if only a relatively small portion of treasury companies are overleveraged, the entire asset class could be at risk. For example, imagine that only 5-10% of treasury companies are overleveraged in order to compete by offering investors more aggressive Bitcoin yields. Let’s call this group "The Gamblers." If these "Gamblers" are required to liquidate their loans when Bitcoin drops by 40-50%, they will be forced to sell Bitcoin to repay their debts. This will further push down Bitcoin’s price, which will then trigger more selling of their stocks and even more Bitcoin sales. This is the reverse of the treasury company flywheel effect. The outcome is often referred to as a "liquidation cascade" in the crypto space (something we have seen many times in the futures market over the years). In this scenario, although most treasury companies may technically be safe from liquidation, the flight of investors could cripple the entire treasury company ecosystem for years. It is for this reason that Capriole has integrated debt data and multiples into our charts and is actively monitoring this risk.

### 2. The Silent Killer: mNAV Compression

The second key risk lies in the dynamics of the premium-to-net asset value (NAV). This risk is more hidden but equally important.

The most popular metric for treasury companies is "mNAV" (market capitalization-to-Bitcoin holdings value ratio), which represents the ratio of a company’s market capitalization to the value of its Bitcoin holdings. When a treasury company trades above the value of its Bitcoin holdings (mNAV > 1), issuing new shares is Bitcoin-accretive—the company can issue stock and increase the amount of Bitcoin per share for investors. It’s a win-win situation. However, problems arise if the mNAV premium evaporates and the stock price falls below NAV (mNAV < 1). At this point, issuing new shares becomes dilutive and destroys value, which hinders fundraising. Companies in this position may face pressure (from internal governance, activist shareholders, or market forces) to liquidate their digital asset holdings to repurchase undervalued shares, hoping to create positive "Bitcoin yields" and push mNAV back up. But this strategy reduces the size of the treasury and undermines investor confidence. Selling by treasury companies will also weigh on the crypto market, creating the negative reverse flywheel effect described above. Essentially, maintaining a valuation above NAV is crucial; once the narrative breaks and mNAV collapses, these companies lose their primary mechanism for expansion—and their long-term contraction will simultaneously shrink the entire digital asset market.

There are many reasons for mNAV declines. The cause could simply be a depletion of capital markets: too much supply of Bitcoin treasury company stocks relative to too little institutional demand. As NYDIG pointed out: "There is no fundamental reason why these premiums must persist. This ‘trade’ reminds us of the ‘GBTC arbitrage,’ which eventually collapsed and brought down nearly all crypto trading. Our intuition is that these premiums to NAV seem to be positively correlated with price. If crypto assets experience a price correction, we suspect these premiums will also collapse."

## Percentage of Treasury Companies Trading Below NAV (mNAV < 1)

Recently, the percentage of Bitcoin treasury companies with mNAV < 1 hit a record high of 27%. This is a worrying trend that deserves attention.

Source: Capriole Charts

While the risk of a single treasury company collapsing may be low, problems arise when you multiply that risk across hundreds of treasury companies, plus the competitive drive each company has to stand out. Over time, these companies have an incentive to move further out on the risk curve, marketing dazzling Bitcoin yield multiples and stock price returns to investors. Here, we recall Buffett’s quote about imitators and greed mentioned earlier.

## The Collapse of Speculative Investment Trusts

The rise of Bitcoin treasury companies echoes another chapter in history: the surge of speculative investment trusts in the 1920s. These trusts allowed people to pool money into an entity, which then invested in leveraged portfolios of common stocks at the discretion of management. "By 1929, new trusts were being launched every day, with valuations 2-3 times their underlying assets. Both the 1920s trusts and Bitcoin treasury companies feature huge mNAV premiums and embrace leverage." (BeWater).

We all know what happened in 1929. Driven by rampant stock market speculation and high leverage, the stock market crashed by 90%, a collapse that was exacerbated by investment trusts.

The 1940 Investment Company Act (ICA) was largely a response to the abuses of investment trusts in the 1920s. It imposed strict regulations on entities "engaged in the business of investing, reinvesting, or trading in securities," requiring them to register with the SEC and meet certain regulatory and leverage constraints.

Today’s digital asset treasury companies are exempt from the ICA because digital assets are not considered "securities." Therefore, despite engaging in activities broadly similar to those of speculative trusts, treasury companies operate without regulation.

"History does not repeat itself, but it often rhymes." — Mark Twain

# The Endgame

At some point, the current hype cycle surrounding Bitcoin treasury companies will reach saturation, which could trigger a sharp wave of liquidations. It is difficult to predict exactly when this will happen, but the indicators and data highlighted above will be key to managing this risk accordingly. For those seeking more in-depth analysis, there is an article that focuses on 8 critical indicators for monitoring the liquidation risks of treasury companies.

While the Bitcoin treasury company flywheel has been the biggest driver behind Bitcoin’s price surge in this cycle, it also poses the greatest downside risk. The fate of the crypto industry now largely rests in the hands of over 150 listed treasury companies.

But will this mark the end? Or will treasury companies thrive in the long run?

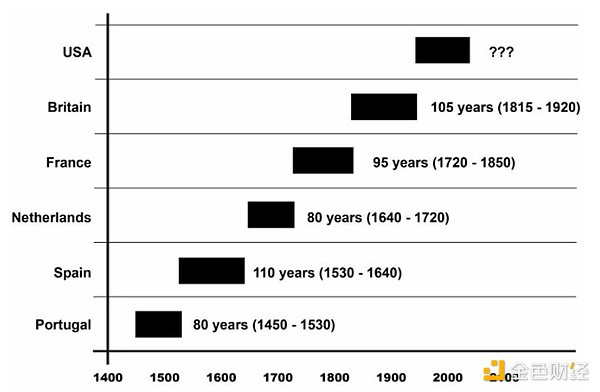

The answer to this question largely depends on whether you believe Bitcoin will successfully fulfill its ultimate mission: becoming the "peer-to-peer electronic cash system" as envisioned by Satoshi Nakamoto. Today, Bitcoin is a $2 trillion asset, inching closer to gold’s $22 trillion market capitalization. Beyond that, global fiat currencies are valued at $113 trillion and growing at a 9% annual rate due to central bank money printing. At its core, Bitcoin is "better gold"—instant, decentralized, fungible, programmable, and with a lower inflation rate than gold (0.4% annualized and declining). This makes it the ultimate store of value and inflation hedge. Gold was once the world’s currency, and the global reserve currency has shifted every 100 years or so. So why can’t Bitcoin go even further?

Following the abandonment of the gold standard in 1971, the next decade presents a golden window for the rise of a new reserve asset.

## Chart of Historical Reserve Currencies, Highlighting the U.S. Dollar’s Duration

The average lifespan of a reserve currency is 94 years. The U.S. dollar is already "long in the tooth."

Source: Dalio (Bridgewater Associates)

In a digital, AI-driven world, could Bitcoin emerge as a contender for the next global reserve asset? This is a philosophical question that all of us need to answer. For my part, I know where I’m placing my bet.

The path ahead will be fraught with twists and turns, but if Bitcoin succeeds, every company in the world will one day become a Bitcoin treasury company—whether they call themselves that or not.

# Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice from this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information contained in the article, nor shall it be liable for any losses arising from the use of or reliance on such information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada