X-trader NEWS

Open your markets potential

Can Bitcoin resist the sell-off as $1.8 billion in profit-making funds enter the market?

# Bitcoin Shows Signs of Fatigue, Typically Preceding Major Directional Volatility

Bitcoin is displaying a state of fatigue, a pattern that usually emerges before significant directional price swings.

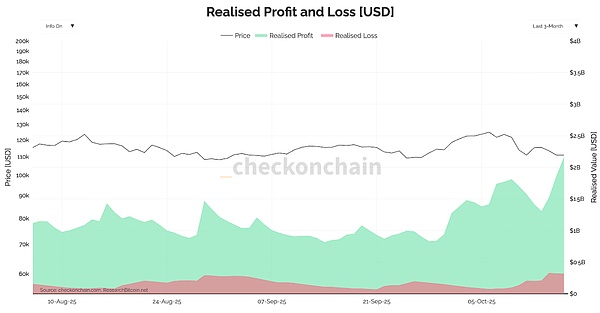

On October 15, traders locked in $1.8 billion in profits—one of the largest profit-taking days since the early summer of this year.

On the same day, the market also recorded $430 million in realized losses.

This data confirms the widespread sentiment in the market since the sharp weekend decline: momentum is gradually fading, and a large amount of capital is flowing toward exit channels.

As of press time, Bitcoin’s price is below $110,000, having dropped by over 10% since the start of October.

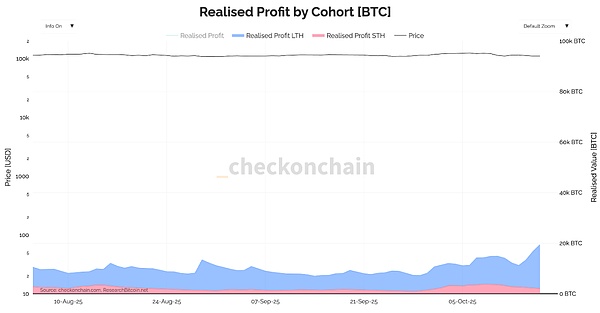

This decline is not a gradual downward drift but rather the result of rapid position liquidation by investors who entered the market in early 2025 and held their positions until now.

Long-term holders (i.e., those with positions held for more than 3 months) were the main force behind this sell-off, and the scale of their realized profits was more than six times that of short-term holders.

Even during the sharp decline last week, long-term holders remained deeply profitable, so it can be determined that their selling was not panic-driven.

Instead, they were engaging in de-risking: choosing to take profits as the market weakened, rather than waiting for a rebound.

After a period of market consolidation, a certain degree of profit-taking is a routine operation. Daily profit-taking of hundreds of millions of dollars can be interpreted as healthy capital rotation.

However, as observed since the start of October, when this capital outflow forms a sustained trend, its nature is no longer "dispersed selling"—instead, it begins to show signs of "market exhaustion."

The scale of realized losses is also on the rise. Although losses are still within a "controllable" range for now, they have climbed in tandem with the scale of profit-taking.

If realized losses continue to grow in line with profit-taking, it may indicate that de-risking is spreading from short-term holders to the broader market.

This spread could be highly contagious, as half of Bitcoin’s short-term holders are currently in a state of unrealized loss.

Data from on-chain analysis platform Checkonchain shows that unrealized losses currently account for approximately 2% of the market capitalization. While the scale is not large, the rate of increase is relatively fast.

If Bitcoin’s price falls below $100,000, this proportion is likely to rise to 5%—a level sufficient to turn the current "unease" in the market into full-blown panic.

Looking at historical data, a situation where more than 30% of the circulating supply is in a loss-making state has only occurred during full-fledged bear markets. Currently, the market is dangerously close to this threshold.

If buyers successfully defend the $100,000 level, Bitcoin may reset its short-term cost basis and restore bullish momentum.

If it breaks below $100,000, the cost basis for new buyers will collapse, and all short-term circulating supply will shift into a loss-making state.

This does not necessarily mean the end of the current cycle, but it could extend the correction further to $80,000—representing a retracement of approximately 35% from the all-time high (ATH).

Given the scale of the current selling pressure, Bitcoin’s stability so far is notable. However, the signals from on-chain data are unambiguous: market confidence is steadily declining.

Bulls are still holding their ground, but each downward candlestick makes it harder for observers to judge whether they are "buying the dip" or "catching a falling knife."

## Disclaimer

The views expressed in this article are solely those of the author and do not constitute investment advice for this platform. This platform makes no guarantees regarding the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume any liability for losses arising from the use of or reliance on the information contained herein.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada