X-trader NEWS

Open your markets potential

The Global Payments Fold: From Tokyo to Nigeria, what is Web3 doing outside of the mainstream narrative?

# Written by: Web3 Farmer Frank

The true meaning of "financial equality" can often only be truly understood through personal experience.

Recently, I have been in Japan. As a Chinese person long accustomed to using QR codes for almost all payments, I did find certain inconveniences here: carrying too much cash, the wear and tear on bank cards from frequent use, and the hassle of setting up and recharging a Suica card (a particular pain for Android users). However, at the very least, I always had Alipay and Visa/Mastercard as backups, so making payments never became an insurmountable problem.

But if we shift our focus slightly south of the equator—to many countries in Africa, Southeast Asia, and Latin America—the situation is entirely different. In these regions, payment is not just a tool; it is a form of "survival skill":

Bank card penetration is extremely low, and many people do not even have a bank account. Small cross-bank transfers come with high fees, unstable processing times, and in some cases, no regular cross-border banking services at all. Even when such services exist, cross-border payment fees are often shockingly high.

In these places, "payment itself" is no longer a taken-for-granted infrastructure like water or electricity, but a privilege.

## I. The World is Folded: From Tokyo to Lagos

For those living in East Asia (such as China and Japan) or Europe and the United States, our experience with payment services is often one of "excess."

The smoothness of WeChat Pay, the versatility of Alipay, and even the tap-and-go convenience of Suica in Japan make us take seamless fund transfers for granted.

Yet the world is not flat, and people’s financial experiences are "folded"—divided by stark inequalities.

Just like the three physically separated spaces in the sci-fi novel *Folding Beijing*, there exists an insurmountable gap in global finance. For example, people in the "first space" may debate which DeFi platforms offer double-digit annual returns, while those in the "third space" worry daily about how to safely bring their hard-earned money home.

Interestingly, against this backdrop, a "counterintuitive" truth in data is often overlooked: While Africa is often stereotyped as "backward," if you look at emerging markets like Nigeria, you will find that their people are not uninterested in digital payments—they are held back by inadequate infrastructure:

According to the latest data from the Central Bank of Nigeria (CBN), internet transfers account for an astonishing 51.91% of the market share (by transaction volume), and POS transactions make up 28.53%. Together, they account for over 80% of all transactions. In contrast, cash withdrawals via ATMs—something we might assume would dominate—account for a mere 2.21%.

This means Nigerians are actually highly reliant on digital payments, particularly direct bank transfers. To put it plainly, this is also because physical payment infrastructure like bank branches is far more costly and harder to deploy than seemingly advanced alternatives like online banking.

As a result, in places like Nigeria, there is no need to teach someone what an "e-wallet" is or how to use it. Driven by practical needs, people there have long been accustomed to using their mobile phones for almost all money transfers. This is analogous to how Axie Infinity gained massive popularity in Southeast Asia as a foundational application—both cases stem from addressing urgent real-world needs.

The only pain point lies in "connectivity." After all, for a freelancer in Lagos, Nigeria, or a migrant worker sending money home from abroad, the average waiting time of 15 minutes or more, combined with exploitative exchange rates, remains a huge black box.

They are highly dependent on digital payments, yet lack stable, low-cost payment infrastructure that connects to the global system. It is against this backdrop that Web3 has truly offered people a new path—one that does not rely on the traditional banking system—for the first time.

## II. Web3 Payments Should Adopt a "Rural Encirclement of Cities" Strategy

This is why I have long believed that the revolutionary significance and immense potential of Web3 and stablecoins in marginalized regions like Africa and Latin America—through a "rural encirclement of cities" approach—have been overlooked by mainstream narratives for a long time.

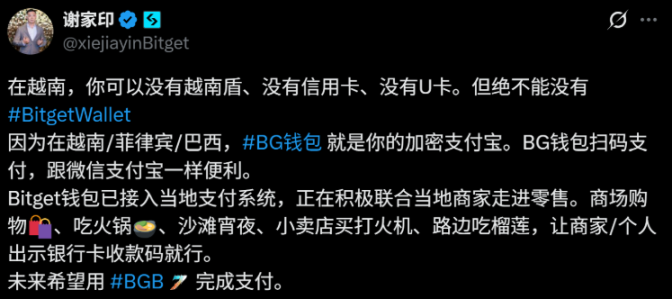

A while back, a video of Xie Jiayin using stablecoins for payments in Vietnam sparked much discussion. Frankly, it also came as a big shock to me.

The key takeaway was that the payment was completed directly via a cryptocurrency wallet transfer, without the need for an "U-card" (a common intermediary tool for converting crypto to fiat for payments) as a middleman.

While扫码-based transfers are common in China, they rely on highly mature, closed-loop online payment networks built by platforms like Alipay and WeChat—systems shaped by China’s unique national context and two decades of internet development, which are hard to replicate elsewhere.

The model shown in the video, however, is entirely different: using Bitget Wallet to scan a VietQR code in Vietnam. While the front-end experience is nearly identical to Alipay, the backend uses the Solana network to process the cryptocurrency transfer, with an intermediate protocol instantly converting the crypto to fiat currency before depositing it into the merchant’s account.

To put it simply, the difference lies in "replicability"—in theory, Vietnam’s model can be replicated in any country with a local instant payment system.

This is particularly true for underdeveloped regions in Africa and Latin America, where smartphones and e-wallets have gained a certain level of popularity, but traditional financial infrastructure remains inadequate.

This also reveals a core user demand: Users do not care about concepts like ERC-20 or Gas Fees. All they care about is "whether they can pay as easily as scanning a QR code."

If we look back at the evolution of stablecoins in the context of Web3 payments, we can identify roughly three stages:

1. **On-chain-only transfers**: A toy for tech enthusiasts. Beyond buying NFTs and using DeFi, it is barely usable in real life.

2. **The "U-card" era**: Converting cryptocurrency into funds on a Visa/Mastercard via issuers. While functional, it has high barriers (cumbersome KYC, expensive card issuance fees, high transaction fees) and essentially still relies on traditional card networks.

3. **Direct-to-Bank connectivity**: Attempting to link on-chain accounts, stablecoin assets, and merchant payment terminals—bypassing issuers and card networks in traditional payment chains. This is currently the most exciting area of exploration.

Payment giants have already begun to "vote" for this direction.

From Circle launching Programmable Wallets and CCTP (Cross-Chain USDC Transfer Protocol) to Stripe, a global payment leader, acquiring Bridge (a stablecoin API service provider) for $1.1 billion at the end of last year—all are efforts to advance toward the third stage.

This includes the recent launch of Nigerian bank transfer functionality on Bitget Wallet, which, supported by Aeon Pay’s infrastructure, offers a "third option" beyond traditional banks and P2P platforms:

- **Decentralization and no KYC**: Unlike traditional exchanges that require tedious identity verification, it retains the censorship-resistant nature of Web3 wallets.

- **Blazing-fast experience**: Compared to the 10–15 minute wait time on P2P platforms, direct transfers here are completed in 5–10 seconds.

- **Low-risk channels**: Funds no longer pass through unfamiliar individual liquidity providers (P2P merchants) but enter the banking system directly via regulated payment gateways, significantly reducing the risk of account freezes.

This also means Web3 wallets are no longer just asset browsers—they are beginning to connect directly to central bank payment systems (such as Nigeria’s NIBSS Instant Payment) via APIs.

From this perspective, the "U-card"—which has dominated the mainstream view until now—is destined to be replaced in the future. Traditional financial institutions will take a more active role in integrating Web3 payment paths and use cases. On the basis of ensuring compliance, they will directly connect the entire chain of user wallets, merchant收款, and asset deposits/withdrawals through bank accounts, payment channels, and clearing systems.

## III. The Ultimate Form of PayFi: When Wallets Become "Invisible Banks"

This also raises a crucial practical question: At this stage, Web3 does not need to reinvent a physical payment network. Instead, it needs to make wallets "penetrate" existing payment networks.

I have always believed that the ultimate form of PayFi might be a purely on-chain payment network that completely breaks free from Visa/Mastercard and even SWIFT:

- **Merchant side**: Accepting stablecoin payments directly, without mandatory conversion to fiat currency.

- **User side**: Initiating transactions directly from non-custodial wallets, with self-custody of funds and instant on-chain clearing.

- **Backend**: Supported by regulated stablecoin issuers and on-chain clearing networks, eliminating the need for Visa/Mastercard or SWIFT channels and completely removing the "tolls" charged by traditional card networks.

Yet this remains an ideal scenario. Before a complete overhaul of the global payment system, the most robust, practical, and sustainable path is still to connect directly to local banking networks via stablecoin payment gateways.

After all, TradFi (traditional finance) excels in regulatory compliance, account structures, and risk control systems, while Crypto has inherent advantages in asset openness, global liquidity, and trustless execution. The combination of the two is currently the optimal balance between "compliance" and "flexibility."

In fact, this trend is already underway.

Take Bitget Wallet’s practice in Nigeria, as mentioned earlier. If we strip away the "Crypto" technical shell, what it is essentially doing is positioning itself as an "offshore banking app with global liquidity":

Imagine a regular user in Lagos. When he opens Bitget Wallet, he is not just getting an on-chain asset management tool—he is getting a "super Alipay" that lets him hold U.S. dollars (in stablecoins) and instantly transfer money to the local grocery store owner’s bank account at any time.

This could well be the prototype of a killer application for PayFi in emerging markets.

Realistically, only when Web3 wallets can seamlessly connect to countries’ real-time payment systems (such as Nigeria’s NIBSS, Brazil’s PIX, and India’s UPI) via compliant channels can this system truly bypass the high costs and inefficiencies of the traditional SWIFT system.

In the near future, products like Bitget Wallet may even surpass existing cross-border payment solutions such as Airwallex and Wise in terms of cost and user experience.

## Conclusion

Payments are the starting point for stablecoins, while "global payments" represent their greater future as a cornerstone of global financial infrastructure.

From integrating QR code payments in Vietnam to enabling off-chain bank transfers in Nigeria, stablecoins may actually play their most important role not in replacing banks, but in filling the gaps where the banking system falls short.

I also hope that in the future, more wallets and Web3 projects will be willing to continue experimenting and deepening their efforts in these complex local scenarios.

Only then will "global payments" cease to be just a narrative and become a tangible reality.

## Disclaimer

The market is risky, and investment requires caution. This article does not constitute investment advice. Users should consider whether any opinion, view, or conclusion in this article aligns with their specific circumstances. Any investment made based on this article shall be at the user’s own risk.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada