X-trader NEWS

Open your markets potential

The application window for Hong Kong stablecoin license opens The issuing bank is expected to seize the opportunity

Source: Securities Times

Image by Tuchong Creative / Table compiled by Xu Ying

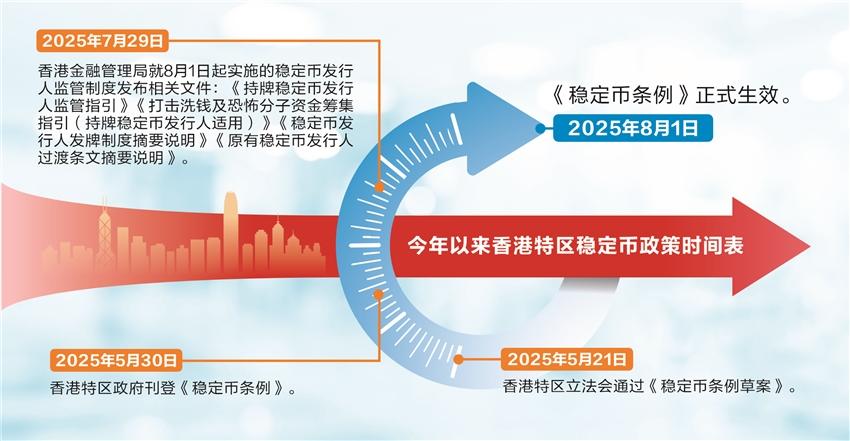

On August 1, Hong Kong's *Stablecoin Ordinance* officially came into effect. The Hong Kong Monetary Authority (HKMA) has recently released a series of supporting guidelines, including the *Guidelines for Licensed Stablecoin Issuers* (hereinafter referred to as the "Guidelines"), which clarify the thresholds for applying for a stablecoin issuer license, covering financial conditions, personnel qualifications, reserve assets, custody and redemption requirements, jurisdiction, and transitional arrangements.

A reporter from Securities Times exclusively learned that note-issuing banks in the Hong Kong Special Administrative Region, such as Bank of China (Hong Kong) and Standard Chartered Bank (Hong Kong), are indispensable entities in this process. Whether driven by their own development needs or regulatory requirements, they are highly likely to be among the first to apply for stablecoin issuer licenses. In addition, Chinese-funded banks, sandbox testing enterprises, large central state-owned enterprises, and major internet companies with payment licenses are also eager to participate.

Securities companies, in the initial stage, will mainly undertake businesses such as stablecoin trading, custody, financing, and consulting, and provide digital asset allocation services related to the tokenization of traditional assets. Currently, 44 securities firms and other institutions have upgraded their virtual asset trading licenses, with 3 new additions compared to the end of June.

### Note-Issuing Banks Expected to Be the First to Apply for Licenses

The issuance of the above-mentioned Guidelines means that the application window for Hong Kong's stablecoin issuer licenses has officially opened. According to the Guidelines, institutions that are fully prepared and wish to obtain approval as soon as possible should submit their applications for stablecoin issuer licenses by September 30.

Earlier, HKMA Chief Executive Eddie Yue stated that in the initial stage, only a maximum of several stablecoin licenses will be issued. A number of industry insiders analyzed to the Securities Times reporter that the number of the first batch of stablecoin issuer licenses is likely to be in single digits, and it cannot be ruled out that there will be only 2 to 3 licenses.

From the perspective of application thresholds, Hong Kong's three note-issuing banks are the most likely to apply and obtain approval first. "Note-issuing banks in Hong Kong, such as Bank of China (Hong Kong) and Standard Chartered Bank (Hong Kong), are indispensable entities. In particular, Chinese-funded banks will take the lead in applying for stablecoin issuer licenses, whether driven by their own development needs or regulatory promotion," an insider with years of experience in cross-border transactions told the Securities Times reporter.

Currently, the Hong Kong Special Administrative Region implements a unique currency issuance system, where banknotes are mainly issued by three commercial banks as agents, supported by U.S. dollar reserves under the linked exchange rate system. These three note-issuing banks are Bank of China (Hong Kong), Standard Chartered Bank (Hong Kong), and HSBC. Considering that stablecoins are pegged to fiat currencies and require full backing by reserve assets (i.e., stablecoins must be reserved with fiat assets at a 1:1 ratio and custodied in compliant institutions such as banks), the role of banks is indispensable.

It should be noted that as of the time of the reporter's dispatch, the HKMA has not issued any stablecoin licenses. In accordance with Hong Kong's regulatory requirements, existing stablecoin issuers must apply for licenses within a 3-month transition period, and those that fail to submit applications will enter a winding-up period starting from November 1, 2025.

### License Issuance Focuses on Application Scenarios

The reporter learned that the competition for the first batch of stablecoin licenses is fierce. Currently, in addition to Hong Kong's three note-issuing banks, Chinese-funded banks, sandbox testing enterprises, large central state-owned enterprises, and major internet companies with payment licenses are all eager to participate.

"The first license issuance will be very cautious. The application scenarios of stablecoins are an important consideration for licensing, and regulators will also assess the applicant's ability to operate sustainably," a senior executive of a listed company in the payment field believes.

A number of interviewed institutional insiders analyzed that the application scenarios of stablecoins may include: first, digital asset trading; second, cross-border payments in global trade; third, tokenization of traditional assets.

According to the above-mentioned senior executive, from a regional perspective, there are differences in the application scenarios of fiat-backed stablecoins. In Europe and the United States, for example, stablecoins are mainly used in the financial sector, such as Bitcoin spot conversion to off-chain ETFs, on-chain money market funds, and on-chain asset collateral in decentralized finance.

### 44 Institutions Upgrade to Type 1 Securities Trading Licenses

The reporter learned that in Hong Kong, securities firms' willingness to apply for stablecoin issuer licenses is expected to focus, in the initial stage of stablecoin business development, on areas highly relevant to their core businesses. It is more likely that they will provide services such as virtual asset trading (including stablecoins), financing, and consulting, as well as digital asset allocation services involving the tokenization of traditional assets.

"For large Hong Kong securities firms, it is necessary to layout virtual asset trading-related licenses. If Hong Kong securities firms can only trade Hong Kong stocks and U.S. stocks, they will lose certain competitiveness in the future," a senior Hong Kong securities firm insider told the reporter.

In the past month or so, securities firms and other financial institutions have begun to research or layout virtual asset trading businesses (including stablecoins), preparing for relevant license applications and upgrades.

According to the latest disclosure by the Securities and Futures Commission of Hong Kong, as of the end of July, a total of 44 financial institutions have successfully upgraded to Type 1 securities trading licenses, with 3 new additions compared to the end of June. Among them, except for a few banks and internet companies, most are securities firms, mainly local Hong Kong securities firms.

Since June, Hong Kong subsidiaries of some mainland Chinese securities firms have also completed the upgrade of Type 1 licenses, including Guotai Junan International, TF International, and Haifu Securities (a subsidiary of East Money).

It is understood that upgrading to a Type 1 license is a prerequisite for securities firms to provide trading services for virtual assets such as stablecoins. The reporter learned that securities firms' virtual asset businesses cover a wide range of crypto assets, such as Bitcoin, Ethereum, non-fungible tokens (NFTs), and security tokens (STOs), and securities firms can provide trading, custody, and other services.

In addition to the upgrade of Type 1 licenses, virtual asset-related licenses also include Type 4 and Type 9 licenses. As of the end of July 2025, 39 institutions have upgraded to Type 4 licenses, enabling them to provide virtual asset investment consulting services (such as Zhongtai International Securities); 42 institutions have upgraded to Type 9 licenses, allowing them to provide asset management services (including Bosera Funds (International) and ChinaAMC (Hong Kong)).

Zeng Yuchao, Managing Director of Futu Group, told the reporter: "Futu Securities obtained the trading license upgrade in July last year, and eligible clients have been able to trade digital currencies since August last year."

### Vigilance Against Concept Speculation Risks

Currently, artificial intelligence and the digital economy are reshaping the global economic development process. Digital currencies represented by stablecoins may become a variable in the reconstruction of the international monetary system. However, the business model of stablecoins is not yet clear. Investors need to be vigilant against risks such as concept speculation and the resurgence of "air coins," while paying attention to issues such as the safety supervision of reserve assets.

From the perspective of the monetary system, a number of interviewed institutional insiders stated that they are more looking forward to the launch of stablecoins pegged to offshore RMB.

This year, ChinaAMC (Hong Kong) launched a number of tokenized funds, including the ChinaAMC RMB Digital Currency Fund. As the first on-chain offshore RMB money market fund, it is regarded as a landmark event in the industry, as it actively explores the possibility of offshore RMB stablecoins.

Disclaimer: The views in this article only represent the author's personal opinions and do not constitute investment advice for this platform. This platform does not guarantee the accuracy, completeness, originality, or timeliness of the information in the article, nor does it assume responsibility for any losses caused by the use or reliance on the information in the article.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada