X-trader NEWS

Open your markets potential

The stablecoin regulations are about to come into effect, and the Hong Kong market is undercurrent

On the upcoming August 1st, Hong Kong's "Stablecoin Regulation" will officially take effect. Compared with the huge waves set off by U.S. stablecoins in the crypto circle, the waves rippling in Hong Kong are only a ripple in the crypto field, but in the stock market, they have rarely shown amazing influence.

Written by: Tuoluo Finance

The wind of stablecoins continues to blow.

While the Stablecoin Genius Act was signed into law by Trump, Hong Kong's stablecoins are counting down to their launch. On the upcoming August 1st, Hong Kong's "Stablecoin Regulation" will officially take effect. Compared with the huge waves set off by U.S. stablecoins in the crypto circle, the waves rippling in Hong Kong are only a ripple in the crypto field, but in the stock market, they have rarely shown amazing influence.

Since the passage of Hong Kong's stablecoin draft, the Hong Kong stock market has shown unprecedented enthusiasm for stablecoins. The Hong Kong stock stablecoin sector has surged, with not only many doubling in price, but also many 10-bagger stocks. Investors talk about it with great interest, and listed companies are happy to receive capital increases. Despite the seemingly joyous situation for all, Hong Kong's regulatory authorities have new concerns. Recently, Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, wrote an article on the official website entitled "Stablecoins for Steady and Long-Term Progress", intending to cool down the surging stablecoin market.

However, in the face of this boiling kettle, it is really difficult to cool it down.

On May 21st, the draft of Hong Kong's stablecoin regulation was passed by the Legislative Council after three readings. At that time, since the U.S. stablecoin bill was still under consideration in the Senate, Hong Kong's "first-mover" operation triggered heated discussions in the market. In fact, in terms of content, the licensing system, 100% full reserve, HK$25 million paid-up capital, anti-money laundering regulations, etc., are no different from the legislation in other mainstream regions. But in terms of public opinion, it's a tale of two extremes, which has become the true portrayal of Hong Kong's stablecoins.

On the one hand, due to the declining influence of Hong Kong in the crypto field, coupled with many first-mover operations that turned out to be more noise than action, the crypto market generally holds a relatively pessimistic view. It is believed that even if Hong Kong continues to consolidate its regulatory foundation and improve regulatory regulations, under limited market demand, it will eventually be just another appendage of U.S. dollar stablecoins, and it is enough to play the residual role of a partial window.

Although the crypto market is not fond of it, the news is a great boon in other markets. After the regulation was passed, major giants with a keen sense of smell rushed to lay out their plans. Traditional media and securities firms also competed to report, allowing stablecoins to achieve a real breakthrough. For a time, discussions on the connotation, application scenarios, and value significance of stablecoins continued to ferment, gradually extending to the debate on the necessity of RMB stablecoins. The trillion-dollar market of stablecoins seems to be on the eve of an outbreak.

This Friday, Hong Kong's stablecoin regulation will officially take effect, and license applications will be opened simultaneously. However, just one week before the effective date, Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, poured cold water on stablecoins. In his article "Stablecoins for Steady and Long-Term Progress", he clearly mentioned that stablecoins are being overly conceptualized and showing a trend of bubbling. Eddie Yue pointed out that at the initial stage, at most only a few stablecoin licenses will be issued. He hopes that investors will remain calm and think independently when digesting positive market news. At the same time, the Hong Kong Monetary Authority will implement the regulatory and anti-money laundering guidelines of the regulation to seek market opinions. In terms of anti-money laundering, more stringent requirements will be formulated to minimize the risk of stablecoins becoming a tool for money laundering.

It can be seen from the above remarks that Hong Kong has expressed concerns about the current market situation and adopted an extremely prudent attitude towards the approval of licenses for stablecoin issuers. The reason why the competent authority has even written articles to pour cold water on the market is quite simple: stablecoins in Hong Kong have indeed become somewhat overheated.

This overheating is concentrated in the stock market. The bright prospects, corresponding to the very initial stage of development, have made stablecoins a rather wonderful capital story. Under this story, almost all stocks related to stablecoins have risen rapidly, with the growth effect being almost immediate.

After Guotai Junan International was approved for a securities trading license in June, becoming the first Chinese-funded securities firm capable of providing full-chain virtual asset services, its stock price soared by 198% on June 25, with a full-year increase of 458%.

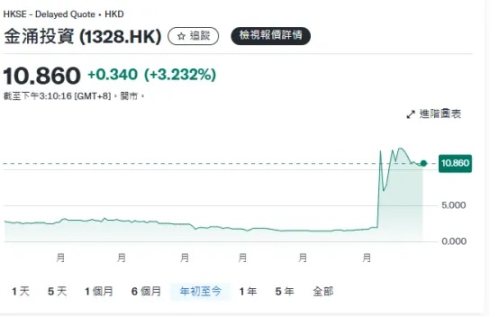

On July 7, King Honor Investment announced that it had signed a strategic cooperation framework memorandum with AnchorX, aiming to explore potential cooperation in four areas including cross-border payment and trade, and the expansion of stablecoin application scenarios. The next day, King Honor Investment's stock price surged by 533.17% with increased trading volume.

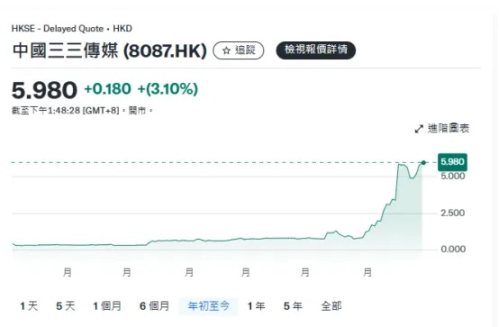

On July 15, China 3C Media announced that the company had started preparations for applying for a stablecoin license. On July 16, China 3C Media's stock price soared 72.73% at the close, with a cumulative increase of as high as 1495% since the beginning of this year.

A single piece of news was enough to trigger a straight-up surge, which fully demonstrates the strong narrative effect of stablecoins. In addition to the institutions newly joining the sector, the original established concept stocks also took off collectively. Companies such as OKLink, Yunfeng Financial, Yixin Group, New Fire Technology Holdings, and OSL Group have all achieved cumulative gains of over 100% this year. Even the long-criticized A-share market has been affected, with digital RMB concept stocks like Hengbao Co., Ltd., Sifang Jingchuang, and Chu Tianlong also seeing multiple-fold increases.

Against this backdrop, all types of entities—whether they are "chameleon" enterprises capitalizing on the hype for capital effects, financial institutions actually seeking a share in the stablecoin market, or strategic giants aiming to reduce settlement costs and build corporate moats—have flocked to join in. Up to now, according to Caixin reports, there are already fifty to sixty companies intending to apply for Hong Kong's stablecoin license, including central enterprises and financial institutions from mainland China, as well as internet giants.

However, the enthusiasm for applications does not translate into enthusiasm for approvals. The Hong Kong Monetary Authority (HKMA) stated that most of the applying institutions are only at the conceptual stage, lacking actual application scenarios. Those that do have application scenarios, on the other hand, lack the technology for issuing stablecoins and the experience and capabilities to manage various financial risks. Issuing stablecoins merely for the sake of issuance is clearly not what Hong Kong wants to see. It is against this background that the HKMA said it would only issue a single-digit number of licenses in the initial stage.

At the same time, in the face of the overheated license applications, the HKMA also intends to adopt a preliminary screening mechanism. Caixin quoted sources as saying that the licenses for stablecoin issuers will not be applied for through a process where applicants download forms by themselves and submit written applications uniformly. Instead, it will be arranged in a manner similar to an invitation-based application system. In practical operations, the HKMA, which is responsible for regulating licensing, will communicate in advance with intended applicants for stablecoin licenses to assess whether they meet the basic application qualifications. Only those who receive basic recognition in the pre-communication will be issued application forms by the HKMA.

As for who will win the licenses? From the perspective of market opinions, the intended issuers that have already participated in the stablecoin sandbox pilot seem to have a greater chance of success. As early as July last year, the HKMA launched the stablecoin sandbox test, with institutions such as JD Digits Chain Technology, Circle Innovation Technology, and the Standard Chartered consortium (including Standard Chartered, Ant Group, and Hong Kong Telecom) selected. Now, the sandbox test has entered its second phase. Although the HKMA emphasized that being selected into the sandbox does not mean that a license will be granted, and sandbox enterprises still need to apply for licenses in accordance with regulations, given the application scenarios and risk control foundations tested in the sandbox in advance, sandbox participants clearly have more experience in meeting regulatory requirements.

Overall, Hong Kong mainly focuses on three key aspects in the license application process: first, technical implementation capabilities, i.e., whether the applicant meets the technical requirements for issuance; second, demand for application scenarios, which requires having practical plans and implemented use cases; third, risk control capabilities, especially in preventing the risk of money laundering through stablecoins. Objectively speaking, large enterprises with an existing extensive foundation in cross-border finance and payment businesses and a complete risk control system have inherent advantages. In contrast, the success rate for small and medium-sized enterprises is rather slim, and most of them are just playing a supporting role.

At this stage, despite the Hong Kong Monetary Authority's call to cool down the market, the market's FOMO (Fear Of Missing Out) sentiment is unlikely to subside quickly.

Firstly, there is a certain linkage between the development of stablecoins in the United States and Hong Kong. After the passage of the Stablecoin Genius Act, the enthusiasm for stablecoins in the U.S. remains undiminished. Circle has hit new highs repeatedly, and major institutions have also expressed strong interest. Coupled with the positive sentiment in the crypto market and the expected interest rate cuts, U.S. stablecoins will continue to have a sustained narrative, which is transmissible.

Secondly, discussions on Hong Kong's stablecoins have continued to expand. Initially, the market only discussed Hong Kong dollar stablecoins themselves, but now, more discussions have focused on the necessity of offshore RMB stablecoins. National think tanks such as the National Financial Development Research Office, local governments like the Shanghai State-owned Assets Supervision and Administration Commission, major securities firms and consulting institutions, and social organizations have all begun to pay attention to this topic. From existing viewpoints, many believe that a pilot program for offshore RMB stablecoins should be launched in the Hong Kong market, and when conditions are ripe, exploration can be carried out in domestic offshore markets represented by free trade试验区. Previously, the slow development of Web3 in Hong Kong was due to blocked channels. If offshore RMB stablecoins are feasible, it will not only bring more imagination to this field and promote the development of the industry itself but also have a far-reaching impact on the existing financial system in the long run.

More importantly, for participants, stablecoins represent a profitable potential market, and a complete industrial chain is gradually taking shape. From the perspective of issuers, for retail-oriented issuers, stablecoins can significantly reduce transaction and settlement costs and enhance competitiveness; for payment-oriented issuers, starting from being a medium to penetrate the digital asset market and move towards global financial infrastructure, there is also ambition involved; even just to add color to stock prices and gain a capital narrative, some participants are motivated to participate. In the recent prevalence of concepts, more than five groups such as ZhongAn Online, 4Paradigm, JiaMi Technology, and Easou Technology have announced large-scale rights issue financing plans. OSL Group placed over 101 million shares at a price of HK$14.9 per share, with a financing plan of nearly HK$2.4 billion. Beyond issuance, virtual asset trading platforms, which are the main carriers for traffic monetization, and custodians mainly composed of banks are actively laying out plans to obtain industry dividends through expansion.

Based on the above, the speculation around stablecoins will continue in the short term, and as a stepping stone in the compliance competition in this market, the competition for licenses will also become intense. However, it is worth noting that as an industry in the early stages of development, the scope and strength of the radiation effect of licenses, and even the feasibility of business demand, remain to be examined. Considering the hard threshold of HK$25 million and the possible annual compliance costs exceeding millions of Hong Kong dollars, without strong business models to support, applying rashly will do more harm than good. As stated in the article by the Hong Kong Monetary Authority, only a few can achieve steady and long-term progress, while more enterprises that just want to ride the wave of hot topics will inevitably return to their original state after being filtered by the license application process.

In this regard, investors who closely follow stocks may need to be more cautious.

Disclaimer: The views in this article only represent the author's personal opinions and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness, originality, and timeliness of the article information, nor does it assume any responsibility for any losses caused by the use or reliance on the article information.

Contact: Sarah

Phone: +1 6269975768

Tel: +1 6269975768

Email: xttrader777@gmail.com

Add: 250 Consumers Rd, Toronto, ON M2J 4V6, Canada